Illustrative Image.

Light oil boost due to supply concerns offset by weak demand

Brent crude oil prices edged higher as concerns over extended supply from Middle East tensions were offset by signs of weakening demand, low trading volumes as a result of the U.S. President’s Day holiday. Brent crude oil futures also stabilized earlier than normal due to the holiday.

Brent crude oil prices rose by 9 cents to close at $83.56 a barrel. U.S. West Texas Intermediate (WTI) crude oil futures for March 2024 delivery rose by 30 cents to $79.49 a barrel. WTI crude oil futures for April 2024 delivery fell by 11 cents to $78.35 a barrel.

Both Brent and WTI oil futures rose by about 1.5% and 3% respectively last week, reflecting increasing risks of conflict in the Middle East.

The conflict in the Middle East continued over the weekend as Israeli attacks forced the closure of Gaza Strip’s second-largest hospital. On Saturday, Houthi fighters linked to Iran from Yemen claimed responsibility for an attack on an oil tanker bound for India. The United States has proposed that the United Nations Security Council condemn Israel’s Rafah attack and support a temporary ceasefire in Gaza.

The market is also awaiting signs of demand trends from China as the country resumes after an extended Lunar New Year holiday.

Gold rises to 1-week high on weaker USD and Middle East conflict

Gold prices reached their highest level in nearly a week on Monday as the U.S. dollar weakened and the conflict in the Middle East boosted the safe-haven appeal of gold.

Spot gold rose by 0.1% to $2,015.49 an ounce at 15:55 GMT, the highest level since February 13, 2024.

U.S. gold futures rose by 0.1% to $2,026.90.

Trading is expected to be thin as most U.S. markets are closed for the President’s Day holiday.

All eyes will be on the minutes of the Federal Reserve’s January policy meeting, expected on Wednesday, for further clues on the timing of interest rate cuts, which would reduce the opportunity cost of holding gold.

The market is currently pricing in a 74% chance of a rate cut in June, according to the CME Fed Watch Tool.

In other precious metals, spot silver fell by 0.8% to $898.41 an ounce, palladium fell by 1% to $940.05, and platinum fell by 1.9% to $22.95.

Iron ore slides as inventories rise, weak steel profit margins overshadow demand prospects

Iron ore prices fell as traders remained cautious amid rising inventories and weak steel profit margins, which countered expectations of increasing demand from China, the leading consumer, after the extended Lunar New Year holiday.

Iron ore futures contracts for May 2024 delivery on China’s Dalian Commodity Exchange closed down 0.52% at 951.5 yuan ($132.20) per tonne.

Iron ore futures contracts for March 2024 delivery on the Singapore Exchange fell by 2.91% to $127.45 per tonne due to fading prospects of early U.S. rate cuts amid stronger-than-expected U.S. production in January.

Iron ore inventories at major Chinese ports increased by 4% during the holiday to 136.76 million tonnes as of February 18, 2024, while profits at surveyed plants fell to 25.54%, the lowest since mid-November 2023, according to data from consulting firm Mysteel.

Coking coal and coke prices fell by 4.6% and 3.2% respectively. Steel prices on the Shanghai Futures Exchange were mixed. Rebar fell by 1.07%, hot-rolled coil fell by 0.88%, while thread steel rose by 0.52% and stainless steel rose by 0.55%.

Copper declines on weak demand from real estate market

Copper prices fell after the People’s Bank of China held interest rates steady for medium-term loans, with the market focusing on the country’s weakening real estate market, although declining inventories limited losses.

Trading volumes were said to be down due to the U.S. holiday.

Copper prices on the London Metal Exchange (LME) fell by 0.6% to $8,442 per tonne after reaching a two-week high of $8,499.50 on Friday.

With China returning from the Lunar New Year holiday, traders and analysts expect increased demand in the coming months.

However, short-term trading will be influenced by decisions concerning interest rates by the Fed and their impact on the USD, as a stronger USD will make metals priced in dollars more expensive for holders of other currencies.

Zinc for three-month delivery rose by 0.9% to $2,406 per tonne. Aluminium fell by 0.8% to $2,201, lead fell by 1.1% to $2,041, tin fell by 2% to $26,430, and nickel rose by 0.3% to $16,410.

Soybeans rebound as corn hits 3-year low

Soybean futures prices on the Chicago Board of Trade rose due to short-covering activity. Corn futures prices set a three-year low for the third consecutive session due to pressure from large supplies, while wheat futures prices extended losses to the lowest level in 2-1/2 months.

Soybean prices rose by 10 cents to close at $11.72-1/4 per bushel, after dropping to the lowest price since December 2020 at $11.60-1/4. Corn prices fell by 1-1/4 cents to $4.16-1/2 per bushel, after hitting the lowest price since December 2020 on Friday at $4.15.

Economists from the USDA said this week that U.S. soybeans will face slowing demand from top importer China and stiff competition from South America. Beneficial rains in Argentina and Brazil have alleviated concerns about crop damage from heat and drought.

“Better weather in South America, along with reduced U.S. exports, gives traders very little reason to buy soybeans in the short term other than short-term profit-taking,” said Pfitzenmaier.

USDA said on Thursday that U.S. soybean inventories will rise to 435 million bushels in the 2024/25 crop year, the highest level since the 2019/20 crop year, and U.S. corn reserves will rise to 2.532 billion bushels, the most since the 1987/88 crop year.

Market reactions to forecasts can be blurred as traders await clearer evidence on U.S. planting trends and more detailed forecasts for 2024/25, Commerzbank said.

In the U.S. wheat market, wheat prices fell by 6-1/2 cents to $5.60-1/2 per bushel and fell by 6.1% for the week.

Coffee and cocoa rise, white sugar falls

In London, cocoa futures prices on ICE increased while white sugar prices fell. The New York market was closed on Monday due to a U.S. holiday. London cocoa futures for May 2024 delivery ended up 1.6% at 4,597 pounds per tonne.

Agents said crop prospects in West Africa continued to deteriorate, potentially increasing the scale of the already large global deficit for the 2023/24 crop year.

High temperatures and insufficient rainfall last week in most cocoa growing regions of Ivory Coast may slow the start and reduce the size of the April-to-September crop.

White sugar futures for May 2024 delivery closed down 1% at $632.10 per tonne.

Agents said weather in Brazil’s Centre-South region would remain a main focus with still concerns about persistent dry conditions despite recent showers.

Robusta coffee futures for May 2024 delivery closed up 1% at $3,172 per tonne.

Japanese rubber at 7-year high on weather concerns, Chinese spending

Japanese rubber futures prices rose for the sixth consecutive session to reach new 7-year highs amid concerns over supply from Thailand, the leading producer, and encouraging consumption data from China, although a stronger yen also weighed on market sentiment. Rubber futures contracts for July 2024 delivery closed up 2.4 yen, or 0.81%, at 298.5 yen ($1.99) per kg, closing at the highest level since February 17, 2017. Rubber prices on the Shanghai Futures Exchange continued trading after a one-week vacation and increased by 245 yuan to close at 13,465 yuan ($1,870.87) per tonne.

The Thai Meteorological Agency warned that severe weather from February 23-25 in Northeast, East, and Central Thailand could damage crops. High daytime temperatures in Malaysia have led to lower latex yields and forced some rubber tappers to work at night, Bernama, based in Malaysia, reported.

Prior rubber futures contracts on the SICOM platform closed the March 2024 delivery session at 154.50 US cents per kg, up 0.13%.

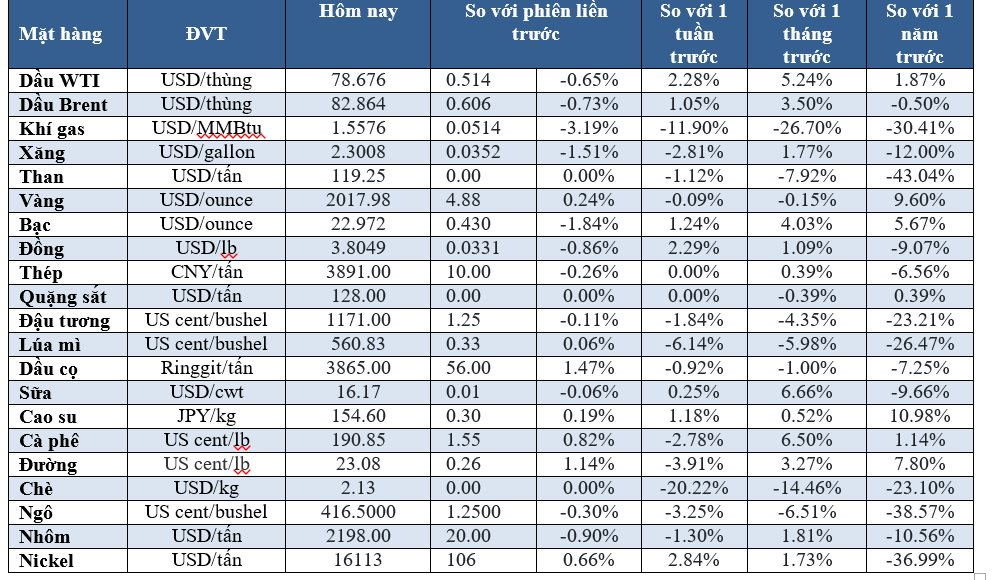

Key commodity prices on the morning of February 20, 2024