Illustrative image

After cooling down in the two trading sessions after the holiday, interbank interest rates have continuously spiked this week.

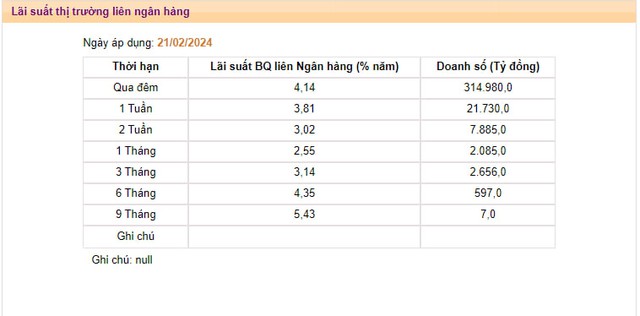

According to the latest data from the State Bank of Vietnam, the average VND interbank interest rate at overnight term (the main term, accounting for about 90-95% of trading value) in the session on February 21 has increased to 4.14% – the highest level since late May 2023. Compared to the level recorded at the end of last week, the overnight interbank interest rate has increased nearly 4 times higher and much higher than many peak levels during the peak period of Tet (2.38% recorded on February 7).

Source: SBV

In this context, SBV has had 2 consecutive sessions of net liquidity injection into the banking system through the open market operations (OMO) loan collateral channel. Specifically, in the sessions on February 20 and 21, there was 1 market member winning the OMO with a total accumulated volume of over VND 6,037 billion, a 7-day term and an interest rate of 4% / year.

This is the first time since the beginning of 2024 that the banking system needs a large source of support from the government. Previously, the winning amount of OMO channel was only around VND 1-2 billion in January and there were no transactions in the second half of 2023.

Sharing with the writer, an expert with many years of experience in the Capital and Bond Source area of a bank said that interbank interest rates increased strongly after the holidays because some of the money deposits of individuals and businesses were withdrawn from the system for Lunar New Year expenses but have not returned yet. At the same time, the reserve compensation demand from a credit institution also contributed to the pressure on system liquidity.

This expert predicted that interbank interest rates will soon cool down in the near future when deposits increase again.

In fact, after 2 consecutive net injections, SBV did not need to support system liquidity in the session on February 22. In addition, the overnight term interest rate is higher than the 1-week – 3-month terms, showing the market’s expectation that interbank interest rates will cool down in the near future.

In the foreign exchange market, USD exchange rates also surged after the Lunar New Year. According to Vietcombank, the bank with the largest foreign exchange trading volume in the system, the USD price is currently bought – sold at VND 24,420 – 24,790/USD, increasing by 220 dong in both trading directions compared to the level recorded before the Lunar New Year. The free USD rate has also increased by about 100-120 dong in both trading directions and is now bought – sold at the level of VND 25,000 – 25,100/USD.

Ban Viet Securities (VCSC) stated that in the first meeting of 2024, the Federal Reserve (Fed) decided to keep the basic interest rate at the level of 5.25% – 5.50%, but the Committee also said that the possibility of reducing interest rates in March is quite low. The statement of the Fed, along with the deep negative interbank interest rate differential, can continue to put pressure on the exchange rate. However, the abundant source of foreign currency supply from FDI, remittances, high trade surplus, and narrowed trade in services deficit (thanks to the continuous improvement of international visitors) can help relieve the pressure on the USD/VND exchange rate.