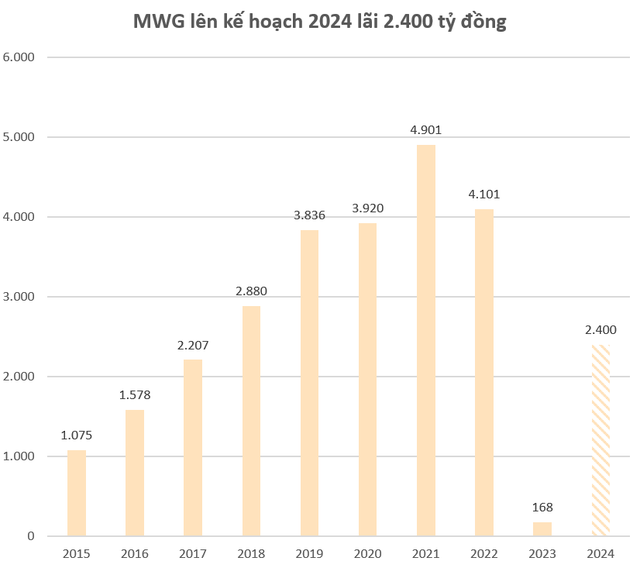

In 2024, Mobile World Investment Corporation (stock code: MWG) plans to do business with revenue of VND 125,000 billion, after-tax profit of VND 2,400 billion, respectively increasing 5% and 14 times compared to the same period last year. In a recent meeting with investors, Mr. Nguyen Duc Tai, Chairman of MWG’s Board of Directors, said that the target of bringing in VND 2,400 billion in profit is not a high figure.

In fact, MWG aims to achieve over VND 100,000 billion in revenue and over VND 2,000 billion in profit, which is a normal thing. Mr. Tai also shared that he and the company’s leaders have learned many lessons after 2023.

“2023 is a year when the market changes very quickly. However, we realized that a bit slow. By the end of the first quarter of 2023, we could catch up with the market’s recognition of declining purchasing power and the difficulty of returning to its peak. When we realized that problem, MWG made changes,” Mr. Nguyen Duc Tai shared.

The chairman of MWG said that the company has had a comprehensive restructuring in the first 9 months of 2023 to prepare for 2024. The company’s operation has also changed a lot to ensure that it is not dependent on the market. No matter whether the market goes up or down, it will not affect the operation system of MWG.

“After the restructuring, we have a streamlined team. Most of our expenses are variable costs. The fixed costs are no longer as much as before. From there, whether the revenue increases or decreases, the costs will follow the revenue. With the new operation model, profit will be ensured. Therefore, the target of VND 2,400 billion profit this year is within reach,” Mr. Nguyen Duc Tai affirmed.

Mr. Nguyen Duc Tai also said that 2024 will still have many risks for MWG’s business situation. The first one is the political conflict between countries. An example can be mentioned is Russia – Ukraine. The chairman of MWG also worried that this conflict could spread to Europe and there will be many unpredictable things happen. However, if the conflict remains as it is now, sales can still improve in the coming year.

No plans to expand new chains

About the expansion plan in 2024, Mr. Nguyen Duc Tai informed that the company has no plans to test new chains. He said that the growth over the next 5 years of MWG will be entrusted to Bach Hoa Xanh chain. Currently, Bach Hoa Xanh does not have a large market share, so there are still many opportunities for expansion both in the provinces where Bach Hoa Xanh is present and in areas that have not been reached such as the Central and Northern regions.

The Gioi Di Dong and Dien May Xanh are still two chains that bring in large profits for the corporation. MWG will seek growth opportunities even when the market does not grow, increase market share. For An Khang, when completing the operating model, the expansion process will take place. As for AVAKids, MWG aims to be the number 1 online chain for mother and baby products.

With the Erablue chain, this chain is still growing as planned and developing well in Indonesia. The supermini model is starting to play a role and be effective. MWG’s efforts to expand Erablue focuses on quality instead of quantity. MWG is confident that Erablue is the “perfect” ICT chain in Indonesia.

May distribute dividends in cash in the future

A question that many shareholders asked during MWG’s investor meeting was when the company would distribute dividends in cash? Mr. Nguyen Duc Tai said that the company is considering that when at the end of 2023 MWG has over VND 8,000 billion undistributed profit after tax. In the upcoming Board of Directors meeting, there will be exchanges, agreements on this issue, and submission to the Annual General Meeting of Shareholders for consideration. The company’s finances currently allow for that.

About the treasury stock issue, Mr. Nguyen Duc Tai said that this is an issue that the company has discussed at many Board of Directors meetings. Accordingly, MWG has agreed to use a portion of the profit to repurchase treasury stock to increase the value for shareholders, which is the right thing to do. If it is approved at the Board of Directors and is approved by the shareholders, this will be a new policy.

“What do you make a profit for? One is to use money to expand production and business. Two is to use money to pay dividends to shareholders. Three is to repurchase treasury stock to increase the benefits for shareholders. According to me, those are the ways that the company can do to increase the benefits for shareholders,” Mr. Nguyen Duc Tai said.

Mr. Tai gave an example that if making a profit of VND 1,000 billion, it is possible to use 20% of that amount to repurchase treasury stock, 20% to distribute to shareholders, and 60% to reinvest. Those are long-term policies over the years, regardless of how the market fluctuates, this is still the executed activity.