Crude oil rises 1%

Crude oil prices rose about 1% as US crude inventories increased less than expected, gasoline and distillate inventories decreased sharply, and the head of the Federal Reserve said he still expects interest rate cuts this year.

A rate cut could boost oil demand by fueling economic growth.

At the close of March 6th, Brent crude oil rose $0.92 or 1.1% to $82.96/barrel, while WTI crude oil rose $0.98 or 1.3% to $79.13/barrel. This made Brent crude oil have its first daily gain in 5 sessions.

The US Energy Information Administration (EIA) reported that energy companies added 1.4 million barrels to inventories, less than expected for the week ending March 1st, while gasoline and distillate inventories decreased more than expected.

For crude oil inventories, analysts in a Reuters survey predicted an increase of 2.1 million barrels, while data from the American Petroleum Institute (API) showed an increase of 0.4 million barrels.

Energy companies also withdrew 4.1 million barrels from distillate inventories, including diesel and heating oil, and 4.5 million barrels of gasoline from inventories in the previous week. Meanwhile, analysts expected a decrease of 0.7 million barrels in distillate inventories and a decrease of 1.6 million barrels in gasoline inventories.

Investors see signs that the Fed cutting interest rates is positive for the economy and oil demand. Non-farm payroll data for the US private sector increased less than expected in February, reinforcing the possibility of interest rate cuts. The USD fell to its lowest level in a month against a basket of other currencies after Powell’s comments.

A weaker USD could boost oil demand by making it cheaper for foreign buyers.

Gold continues to hit record highs

Gold prices rose to a new record mainly thanks to bets on the easing of US monetary policy, while palladium returned above $1,000 for the first time since January 12th.

Spot gold rose 0.8% to $2,145.09/ounce after hitting a record high of $2,152.09/ounce in this session. US gold for April delivery closed up 0.8% at $2,158.2/ounce. Silver rose 1.9% to $24.15/ounce.

Gold rose further as the USD fell after Federal Reserve Chairman Jerome Powell indicated interest rate cuts later this year.

Gold is affected as high US interest rates increase returns on competing assets such as bonds and push the USD higher, making gold more expensive for foreign buyers.

Meanwhile, platinum rose about 3% to $906.7/ounce while palladium soared nearly 10% to $1,035.83/ounce.

Copper rises as the USD weakens, inventories remain low

Copper prices in London rose as the USD weakened and inventories remained low due to concerns about large stimulus policies from China.

The LME price of copper for 3 months delivery rose 0.9% to $8,565.5/ton.

The USD index dropped after Federal Reserve Chairman Jerome Powell said progress towards inflation was not guaranteed, although the central bank still expects interest rate cuts later this year.

LME copper inventories continued to decline and reached a new low in 6 months.

A Reuters poll showed that China’s export growth could slow in the first two months of this year, indicating that producers still struggle to attract foreign buyers.

Iron ore drops as the steel market weakens

The price of iron ore dropped as the steel market continued to weaken and concerns about large stimulus packages from China intensified.

Dai Lien iron ore contracts for May delivery on the Dalian Commodity Exchange, China, closed down 0.23% to CNY 881.5 (USD 122.44)/ton.

Policymakers in China, the world’s second-largest economy, on March 5th announced key economic targets for 2023, reinforcing most market expectations, disappointing those looking for larger stimulus measures benefiting metal consumption.

Iron ore contracts for April delivery on the Singapore Exchange rose 0.75% to $115.3/ton.

In Shanghai, steel prices fell amid weak demand. Rebar fell 0.7%, hot-rolled coil fell 0.77%, wire rod fell 1.25%, and stainless steel fell 0.8%.

Japanese rubber rises for the second consecutive session

Japanese rubber prices rose for the second consecutive session amid high oil prices and concerns about the weather in Thailand, the leading producer, while the expansion plans of Chinese and Japanese manufacturers continue to boost market sentiment.

Rubber contracts for August delivery on the Osaka Exchange closed up 0.5 JPY or 0.17% at 299.9 JPY (2 USD)/kg.

In Shanghai, rubber for May delivery rose 35 CNY to 13,805 CNY (1,917.55 USD)/ton.

Oil prices rebounded as major producers continued to cut output.

Natural rubber often follows oil price adjustments as they compete for market share with synthetic rubber made from crude oil.

Thailand’s meteorological agency warned of very hot weather in rubber-producing areas in Thailand from March 6th to 8th and a summer storm in this area from March 8th to 10th, which could damage the tapping season.

Robusta coffee rises 4% to the highest level in 16 years

Robusta coffee for May delivery closed up $129 or 4.1% at $3,309/ton after reaching $3,328, the highest price since the current contract form began trading in January 2008.

Exporters are struggling to purchase coffee in Vietnam, with some farmers waiting for higher prices while shipments to Europe are delayed due to attacks in the Red Sea, contributing to supply constraints.

ICE coffee inventories reached 23,350 tons as of March 5th, sharply down from 74,000 tons a year earlier.

Arabica coffee for May delivery rose 1.6% to $1.863/lb.

Brazil exported 3.61 million bags of coffee in February, up 77% year-on-year.

Sugar price rises

Raw sugar for May delivery closed up 0.58 US cents or 2.8% at 21.45 US cents/lb after falling to its lowest level in 2.5 months at 20.53 US cents.

Dealers said prospects of sugar production were improving in the leading exporting country of Thailand, one of the factors putting pressure on prices.

Sugar for white delivery in May rose 2.8% to $611.00/ton.

Corn rises, wheat and soybeans drop

Corn prices on the Chicago Mercantile Exchange closed slightly higher after a volatile session, supported by bargain hunting ahead of a monthly supply-demand report from the US government.

CBOT corn for May delivery closed up 2-1/2 US cents at $4.28-3/4/bushel. Corn prices rose and fell during this session.

Chicago soft red winter wheat fell to its lowest level since mid-2020, indicating fierce export competition globally from suppliers in the Black Sea, especially Russia.

Chicago soft red winter wheat for May delivery closed down 20 US cents at $5.31/bushel after falling to a low of $5.29-1/2, the lowest level since August 2020.

Soybeans dropped but this contract held near its 3-year low set the previous week as investors await fresh news.

CBOT soybeans for May delivery closed down 3/4 US cents at $11.48-1/4/bushel.

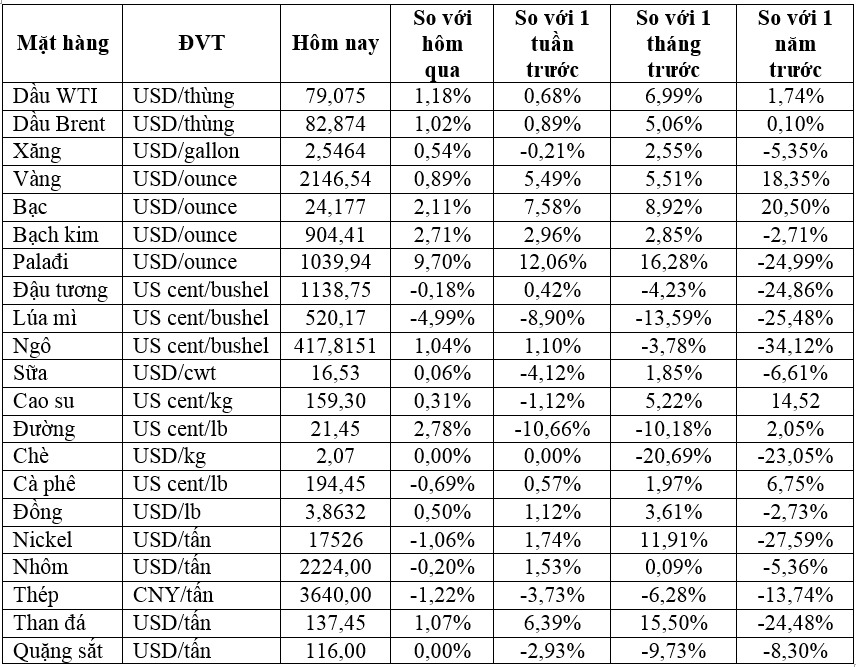

Prices of key commodities as of the morning of March 7th