The results saw 6 winning bidders with a total volume of VND 14,999.8 billion and an interest rate of 1.4% per annum.

The actions of the operator took place in the context of abundant VND liquidity and pressure on exchange rates in recent weeks.

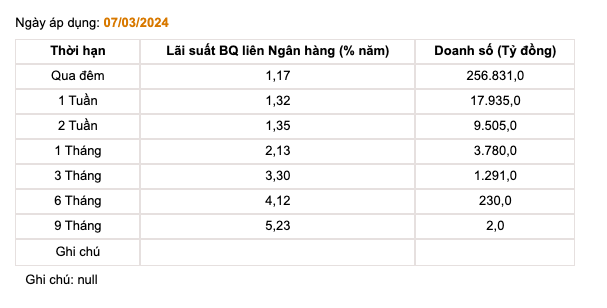

Interbank interest rates have sharply fallen back after the Lunar New Year, indicating that liquidity is not under strain as credit growth remains weak. As of March 7, the overnight interbank interest rate (accounting for 90% of transactions) was only 1.17% per annum. On the other hand, as of February 16, 2024, credit growth reached -1% YTD (from the beginning of the year), continuing to decline sharply compared to the -0.6% YTD level by the end of January 2024.

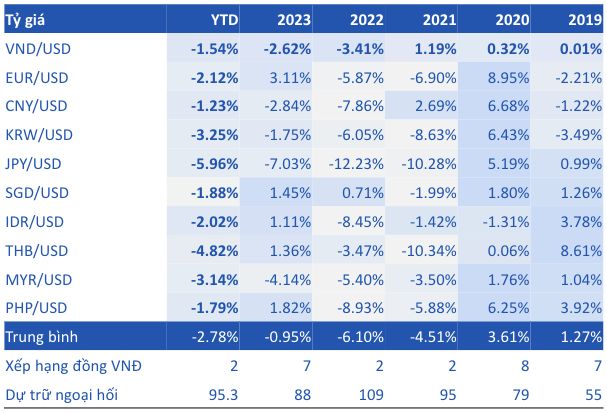

The exchange rate continued to climb in February 2024 after the FED signaled greater “hawkishness” in its January 2024 meeting. In the first 2 months of the year, VND depreciated by 1.54% against USD. However, compared to other currencies, from the beginning of 2024, VND remained the second most stable currency, after CNY.

Entering March 2024, the pressure on the exchange rate has not eased as on March 11, the USD exchange rate on the free market reached the level of 25,500 – 25,700 VND/USD (buy – sell) – the highest level in the past 5 years.

According to analysts, the pressure on the exchange rate is only temporary when (1) production recovers, leading to high demand for foreign currency for import activities and (2) the VND – USD interest rate differential is deeply negative, and systemic excess liquidity stimulates foreign currency speculation activities.

The latest time the State Bank of Vietnam drained funds through the discount bond channel was from September 21 to November 9, 2023. The State Bank of Vietnam had 34 discount bond issuances with interest rate auctions and a term of 28 days. The total value of the bonds issued reached 360,345 billion VND. On October 19, the first batch of bonds matured. Since this time, the State Bank of Vietnam has gradually reduced the intensity of fund drainage through the discount bond channel. In October 2023, at the peak pressure points of the exchange rate, the scale of circulating bonds reached 260 trillion VND (far exceeding the same period in 2022 when the State Bank of Vietnam only drained a net liquidity of 150 trillion VND). The interest rate at the end of October 2023 reached 1.5% per annum.

The macroeconomic data released by the General Statistics Office showed that import and export in February 2024 continued to have positive developments as the demand for goods in Vietnam’s main export markets (US, Europe, etc.) recovered. The trade balance surplus reached 4.72 billion USD, expanding compared to January, indicating that export activities continued to grow faster than import activities.

In the first 2 months of 2024, FDI continued to maintain its momentum. Specifically, realized FDI increased by 9.8% compared to the same period last year (YoY), registered FDI (excluding capital contribution and share purchase) increased sharply by 75.61% YoY. FDI mainly poured into the processing and manufacturing industry, followed by real estate. China is the leading partner in terms of new investment projects (accounting for 32.3%).

The PMI manufacturing index in February 2024 was 50.4 points, recording improvement after surpassing the 50-point threshold in January, but the overall increase was still relatively weak. Businesses remain cautious in purchasing and maintaining inventory levels.