On March 14, in a conversation with reporters, Mr. P.H.A (residing in Ha Long City, Quang Ninh) said that he himself did not borrow credit of 8.5 million VND from Eximbank branch in Quang Ninh.

According to Mr. H.A, in 2012, through a friend, he asked a male employee (can’t remember the identity) of Eximbank branch in Quang Ninh to apply for a credit card.

At this time, the bank employee asked Mr. H.A to sign the credit card opening contract and receive the card. After that, he gave Mr. H.A a regular card with the explanation that the credit card was having trouble.

Thinking that he couldn’t use it, Mr. H.A didn’t pay much attention to it. In 2016, when Mr. H.A had the need to borrow money from the bank, he was informed that he had bad debt at Eximbank branch in Quang Ninh.

Mr. H.A went to Eximbank branch in Quang Ninh to inquire and was informed by the bank that he had to take responsibility for the credit card that was previously opened. It was a surprise to him, so Mr. H.A requested to review the credit card opening dossier and detailed statement.

In the statement, Mr. H.A’s credit card had borrowed money to buy a phone for over 9 million VND. According to Mr. H.A, the signature in the statement does not match his signature in the card opening dossier. What’s more, in the bank’s statement, there were 2 times of repaying interest within 2 months, and Mr. H.A affirms that he did not know about this.

Another thing, in the credit card opening dossier, there are 2 phone numbers, one of Mr. H.A and another unknown number. Later, that unknown number was no longer in use. The bank employee who had assisted in opening the card had quit and his address is unknown now.

Mr. H.A wonders why when the bank saw the bad debt, they did not notify him at that time.

“Although I am the victim, I don’t want to affect my personal image, so I have the need to resolve the consequences of the debt amount, but the bank does not agree and requires me to repay both the principal and interest that the credit card borrowed”, Mr. H.A said.

From 2016 until now, Eximbank branch in Quang Ninh and Mr. H.A have met many times to resolve the issue, but there is no common voice.

Mr. H.A added that the bank requested a local confirmation letter confirming that he has no ability to repay. Mr. H.A does not agree with the reason that if he asks for that letter, it means that Mr. H.A is a fraud.

According to Mr. H.A, the bank also does not inform him how the interest is calculated, starting from 8.5 million to over 8 billion VND.

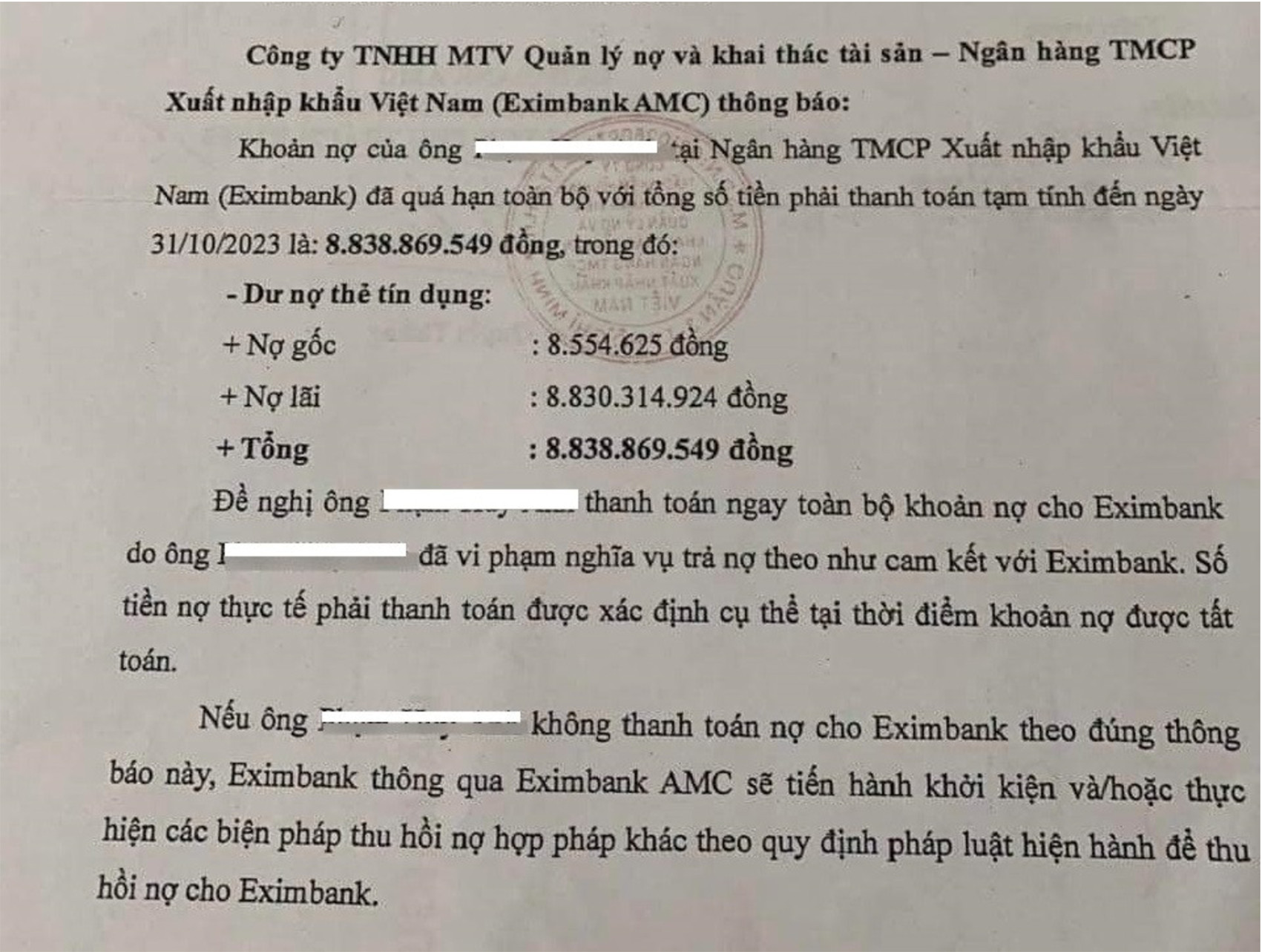

“In 2023, Eximbank branch in Quang Ninh sent a debt reminder letter to me with a repayment amount of over 8.8 billion VND, and without repayment, I would be sued. I also want to clarify this matter because I did not know that the credit card existed and who used that card to borrow money and asked me to take responsibility”, Mr. H.A said.

On March 13, on social media platforms, a debt reminder letter from the company Ltd. Debt & Asset Management – Vietnam Export Import Commercial Joint Stock Bank (Eximbank AMC) to customer named P.H.A in Quang Ninh is spreading.

According to the content of the letter, Eximbank AMC informs the customer about the debt amount over 8.83 billion VND, of which the principal debt is only 8.55 million VND. This information makes many people curious and even shocked when they see “like mother like child interest”, so the speed of sharing is pushed high.

To clarify more about the information Mr. H.A provided, VietNamNet contacted the media representative of Eximbank. According to the bank’s media representative, this information has been forwarded to Eximbank AMC and the business is currently verifying and responding to it.

Pham Cong