Illustrative Image

|

WSB’s Board of Directors has just approved the Annual General Meeting documents for 2024, scheduled to be held on March 26th at 132-134 Dong Khoi Street, Ben Nghe Ward, District 1, Ho Chi Minh City. The ex-dividend date is February 22, 2024.

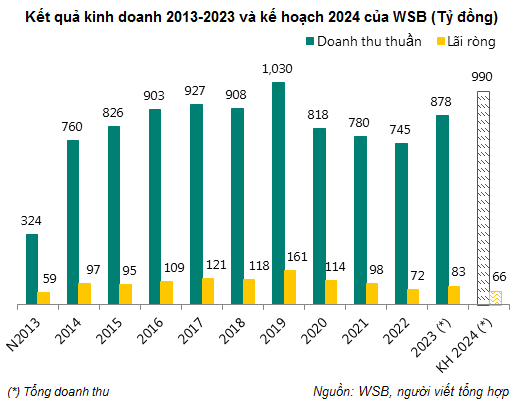

Lowest profit target in 11 years

In 2024, WSB’s management expects the company to face many challenges due to high raw material prices, increased input costs, and slow market recovery in consumer demand. Despite these fluctuations, the company proposes a total revenue target of over VND 990 billion, a 13% increase compared to 2023; however, net profit is expected to decrease by 21% to nearly VND 66 billion.

If achieved, this will be WSB’s lowest net profit in 11 years since 2014.

Looking back at 2023, WSB’s total revenue reached nearly VND 878 billion, a 15% increase compared to the previous year, but only 83% of the annual plan was achieved due to underperforming delivery volume, especially in bottled beer products. Thanks to lower-than-expected raw material prices and cost savings, net profit increased by 16% to VND 83 billion, exceeding the set plan by 32%.

With the achieved results, the company proposes a dividend payout of 40% in cash for 2023 – higher than the planned 30% and the highest in the past 3 years since 2021. The company already made an interim dividend payment of 10% in December 2023. Therefore, WSB will have at least one more dividend payment of 30%. The specific time has not been announced yet.

In 2024, the company plans to maintain a 40% cash dividend ratio.

Bia Sai Gon – Mien Tay (WSB) was established in 2006, based on the merger of two units: Sai Gon – Can Tho Beer Joint Stock Company and Sai Gon – Soc Trang Beer Joint Stock Company. Since trading on the UPCoM in 2010, the company has a history of paying regular annual cash dividends to shareholders, averaging around 30%.

Most of the dividends will flow back to the parent company, Saigon Beer – Alcohol – Beverage Corporation (Sabeco, HOSE: SAB) – owning 70.55% of WSB’s capital. Next is AFC Vietnam Fund, holding 7.22%.

Due to concentrated shareholder structure, WSB’s stock liquidity on the market is very limited, with almost no transactions. As of the end of March 12th, WSB’s stock price remained at the reference level of VND 51,300 per share, an increase of over 5% compared to the beginning of the year.

| WSB Stock Price Movement |

| AFC Vietnam Fund (AFC VF Limited) |