Crude oil prices rise

Crude oil prices have reached the highest level in 4 months as the International Energy Agency (IEA) predicts a tighter market by 2024 and raises its forecast for oil demand growth this year.

Brent crude oil futures for May delivery rose $1.39, or 1.7%, to settle at $85.42 a barrel, the highest closing level since November 6.

US West Texas Intermediate (WTI) crude oil futures for April delivery rose $1.54, or 1.9%, to settle at $81.26, also the highest since early November.

The IEA forecasts that oil demand will increase by 1.3 million barrels per day by 2024, an increase of 110,000 barrels per day compared to last month’s forecast, but still lower than the 2.3 million barrels per day growth in the previous year.

The IEA also cuts its supply forecast for 2024 and now expects oil supply to increase by 800,000 barrels per day to 102.9 million barrels per day this year.

Gold falls

Gold prices fell after US Producer Price Index (PPI) for February came in higher than expected, dampening expectations that the Federal Reserve will soon cut interest rates and boosting the yields on government bonds and the US dollar.

Spot gold ended the session down 0.6% at $2,161.39 per ounce. US gold futures for April delivery fell 0.6% to $2,167.5.

The US dollar strengthened 0.6% against major currencies, making gold less attractive for those holding other currencies, while the yield on the US 10-year bond rose to its highest level in over a week.

Copper declines

Copper prices in London fell on Thursday, retreating from an 11-month high as the market doubted China’s plan to cut production while demand in the world’s top consumer of the metal remains lackluster.

Three-month copper on the London Metal Exchange (LME) fell 0.3% to close at $8,902 per tonne, after surging to $8,976.50, the highest since April 19 last year.

Copper also came under pressure as the US dollar index rose sharply after data showed US factory gate prices rose more than expected in February.

Iron ore continues to decline

Iron ore prices fell on Thursday on prolonged concerns about demand in China.

The May iron ore contract on the Dalian Commodity Exchange (DCE) of China closed down 2.62% at 798 renminbi ($110.94)/tonne, the lowest since August 22, 2023.

The April iron ore contract on the Singapore Exchange fell 2.37% to $103.05/tonne, the lowest since August 17.

However, analysts at First Futures said in a note that it is not easy to see iron ore prices fall below $100/tonne in the short term due to low stockpiles at Chinese mills and downstream areas still needing to buy additional goods.

Cocoa surges over 4%

Cocoa futures on the ICE continental exchange rose over 4% on Thursday as there are no signs of ending the supply crunch that has led processing plants in the world’s top producers of cocoa, Ivory Coast and Ghana, to cut or halt processing.

The July cocoa contract traded in London rose £255, or 4.9%, to close at £5,480 per metric ton, after hitting a fresh all-time high of £5,565.7/ton.

Major plants in Ivory Coast and Ghana have stopped or cut back processing as they don’t have enough capacity to buy raw materials at the elevated prices after three years of poor harvests and a fourth is expected to be equally poor.

The July cocoa contract traded in New York also rose 4.3% to $6,759/ton, after hitting a new high of $7,021/ton.

Rubber continues to rise

Rubber futures on the Tokyo market continued to rise for the eighth session, hitting a 7-year high, amid concerns over supply and rising oil prices.

The rubber contract for August delivery on the Osaka Exchange (OSE) rose 4.6 yen, or 1.4%, to close at 333 yen ($2.25)/kg, the highest closing level since January 31, 2017.

The rubber contract for May delivery on the Shanghai Futures Exchange (SHFE) rose 200 renminbi, closing at 14,380 renminbi (1,999.25 USD)/tonne.

Coffee rises

Robusta coffee futures for May rose $17, or 0.5%, to $3,277/tonne.

Robusta coffee prices in the world’s top producers – Vietnam and Indonesia – rose this week as supply remains scarce, with increasing concerns about the next harvest season due to lack of rain at this time.

Arabica coffee for May rose 0.7% to $1.8385/lb.

Supplies of Arabica coffee in Brazil are expected to remain tight as the new harvest is not expected to hit the market soon.

Wheat, corn, soybeans decline

Wheat futures on the Chicago Board of Trade (CBOT) tumbled on Thursday, reaching the lowest level since 2020, dragging corn prices lower. Soybeans also fell as short-selling and profit-taking took hold.

May wheat fell 12 US cents to $5.32-1/4/bushel, close to the low of $5.23-1/2 touched on Monday, the lowest since August 2020 for the most-active contract. May corn fell 7-1/2 US cents to $4.33-3/4/bushel. May soybeans also fell 1-1/2 US cents to $11.95-1/4/bushel.

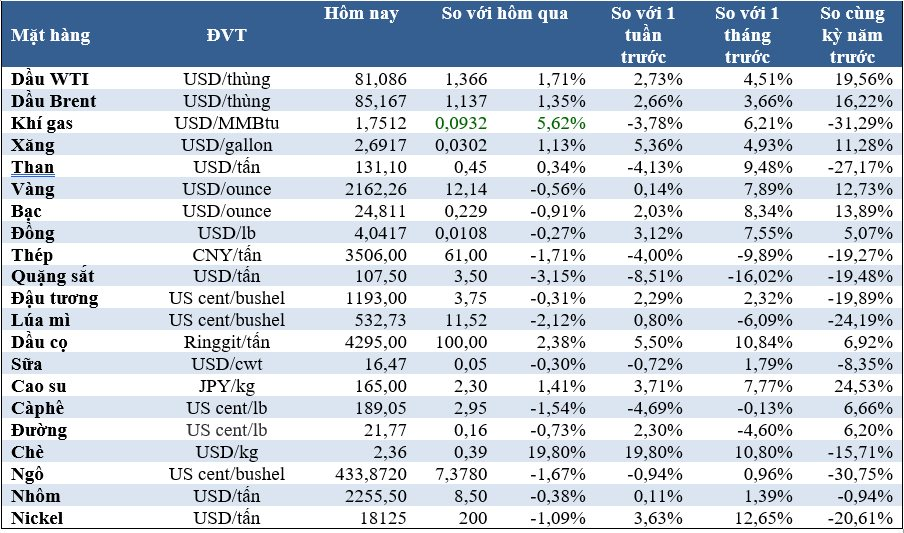

Key commodities prices on March 15th, morning: