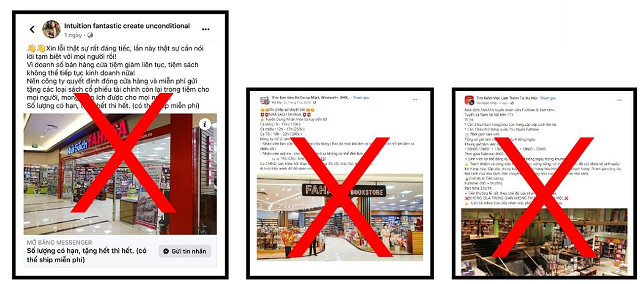

Some information about bookstore closures on Facebook. Source: FHS

|

Scamming behavior

Immediately after that, Fahasa Joint Stock Company (Fahasa, UPCoM: FHS) clarified this misinformation.

In the announcement issued on 03/03, FHS stated that this is a scamming behavior with the purpose of attracting viewers to the page to advertise other activities of the individuals who own these social media accounts.

FHS warned that this is a violation of the law, seriously affecting the company’s reputation, and will take strong measures to protect the company’s interests, including reporting to state management agencies and the police.

“Through this announcement, Fahasa company officially informs customers, partners, suppliers,… about the fact that Fahasa company is still and will continue to operate normally. The business situation in the first months of 2024 has good results, increased revenue, and the system of 120 bookstores nationwide continuously serves a large number of customers” – FHS said.

On the morning of March 11, FHS held a press conference on the company’s activities, Chairman of the Board of Directors Pham Minh Thuan affirmed that the fake acts, posting false information were “not intentionally undermining Fahasa” but taking advantage of the reputation and quality of the business for “likes, views” to serve other purposes.

FHS organized a meeting on the company’s activities. Source: FHS

|

Record high net profit, earning VND 11 billion per day

Despite the difficult economy, FHS ended 2023 with a record net profit of VND 56 billion, up 51% compared to 2022, while revenue remained unchanged. The Fahasa bookstore unit recorded VND 4 trillion in revenue, equivalent to VND 11 billion per day. Gross profit margin in 2023 reached 24.6%, continuing to improve compared to the previous year, and also the highest level to date.

| Net profit of FHS from 2013 to present |

Explaining this, FHS said that thanks to the exploitation of new goods from suppliers inside and outside the country, efficient business programs, and good cost management, the profit has increased.

Looking back over the past decade, FHS net profit has continuously increased in the period from 2013 – 2023, now four times higher than 10 years ago, despite being stagnant in 2020 and 2021 due to the COVID-19 pandemic, equivalent to an average annual growth rate of nearly 15%. In this period, revenue increased by 167%, from about VND 1.5 trillion to VND 4 trillion.

However, the gross margin from publishing and book business is still very low, at around 1%, due to large sales costs, of which more than half is allocated to sales staff.

For example, in 2023, FHS spent VND 848 billion on this cost, accounting for over 86% of the gross profit. This means that after deducting the cost price, every VND 100 earned, VND 86 is spent on sales activities. This low proportion in recent years partly reflects the most efficient business activities.

In 2023, the record profit helped FHS achieve a high return on equity (ROE) of nearly 30% and continuously increased in the past 2 years, surpassing the 10-year period (average below 20%).

| Gross profit and sales cost of FHS from 2013 to present |

Business model of FHS focuses almost entirely on short-term assets, accounting for nearly 94% of total assets, recorded at VND 1.3 trillion at the end of 2023. Corresponding to this number on the balance sheet is mainly focused on VND 1 trillion payable to short-term suppliers, accounting for 83% of total liabilities.

Half of the short-term assets come from inventory (VND 697 billion). The remaining majority is for investments held until maturity (VND 435 billion).

FHS almost does not borrow or borrows very little. In the past 10 years, Fahasa bookstore company borrowed the most amount of about over VND 20 billion in 2019, which is insignificant compared to the revenue earned.

| Borrowing and debt repayment of FHS from 2013 to present |

Larger scale than competitors, continuously opening new bookstores

Established since the 70s, Fahasa is still maintained as the largest bookstore chain with a network of 120 stores in almost all provinces and cities across the country. The scale of FHS chain as well as its revenue far surpasses its competitors. For example, Cultural Joint Stock Company Southern (HOSE: PNC), the parent company of Phuong Nam Bookstore, currently has about 50 bookstores (according to the website) with revenue and net profit in 2023 of VND 660 billion and VND 11.7 billion, respectively.

Or ADC Advertising and Fine Arts Joint Stock Company (HNX: ADC), which owns a chain of 12 ADCBook stores, mainly in Hanoi (according to the website). ADC’s revenue for the whole year of 2023 is 1/10 that of FHS, about VND 431 billion, with a net profit of VND 14.2 billion.

Currently, subsidiaries of FHS include Nguyen Hue Book Center, Xuan Thu Book Center, Phu Nhuan Book Center, Gia Dinh Book Center, Fahasa Hanoi Book Center, fahasa.com e-commerce center, Technology Center, and Printing – Stationery – Packaging Enterprise.

Cultural Commerce Joint Stock Company Binh Duong, a subsidiary owned by FHS with 74.04% of capital, also owns 11 bookstores, mainly in Binh Duong, Tay Ninh, etc.

Chairman of the Board of Directors Pham Minh Thuan at the opening ceremony of Fahasa Kien Giang bookstore on March 6th. Source: FHS

|