Escape from suspension after 6 consecutive months of no violation of information disclosure

According to HOSE, within 6 consecutive months since the decision to suspend trading was issued, HPX did not violate the regulations on information disclosure. On March 8, 2024, HPX announced the audited financial statements for the year 2023 (separate and consolidated).

HOSE said it will lift the suspension and resume full-time trading of HPX shares in accordance with regulations.

Prior to that, on March 7, 2024, HPX announced that it had rectified the suspended situation of the securities and requested the resumption of trading of HPX shares. Specifically, on September 10, 2023, HPX announced the semi-annual separate financial statements for the year 2023, and one day later, HPX announced the semi-annual consolidated financial statements for the year 2023.

In addition, HPX stated that it proactively prepared the financial statements for the year 2023 and received partial approval from CPA VIETNAM Audit Company. The audited financial information for the year 2023 was disclosed on March 7, 2024.

Returning to the period from late August 2023, HPX consecutively announced the audited financial statements for 2022, quarterly and semi-annual separate and consolidated financial statements for the first 2 quarters of 2023. Although the company has fulfilled its obligations to disclose the information, it exceeded the regulatory time limit, so HOSE decided to transfer HPX shares from the restricted list to the suspended list from September 18, 2023.

Therefore, after about 6 months of suspension, more than 304 million HPX shares have resumed full-time trading.

Highest revenue plan in 5 years

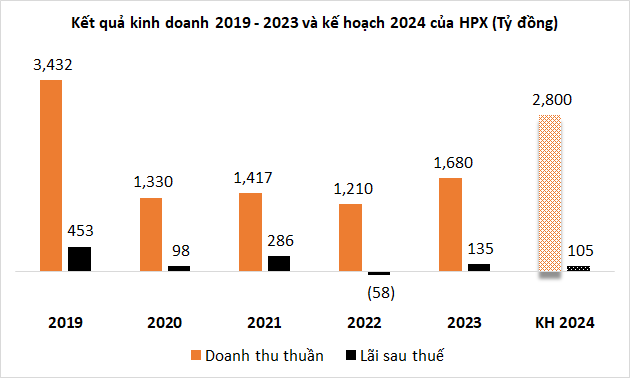

On March 4, the Board of Directors of HPX approved the business plan for 2024 with a target consolidated revenue of VND 2,800 billion, a 67% increase compared to the previous year and the highest level in the past 5 years (since 2020). However, the expected post-tax profit will decrease by 22% to VND 105 billion. The parent company’s dividend rate is expected to be 5%.

HPX stated that it will focus on balancing cash flow, arranging capital to implement projects, balancing sources to pay taxes, repay principal and interest to stakeholders, and extend bonds and credit packages. In addition, the company will issue and disclose financial statements within the prescribed time limit and restructure the ratios at subsidiary and affiliate companies.

Regarding investment and deployment of projects, HPX said that the Bac Giang project will be completed and handed over in June 2024, the Cao Bang project will begin phase 2 construction in June 2024, the Lao Cai project and the Hoa Binh Pearl Island project.

In 2023, HPX recorded net revenue of over VND 1,680 billion, a 39% increase compared to the previous year. Net profit exceeded VND 127 billion, while in 2022, there was a loss of more than VND 60 billion. Compared to the plan, HPX surpassed the minimum post-tax profit target of VND 120 billion set for 2023.

Source: VietstockFinance

|