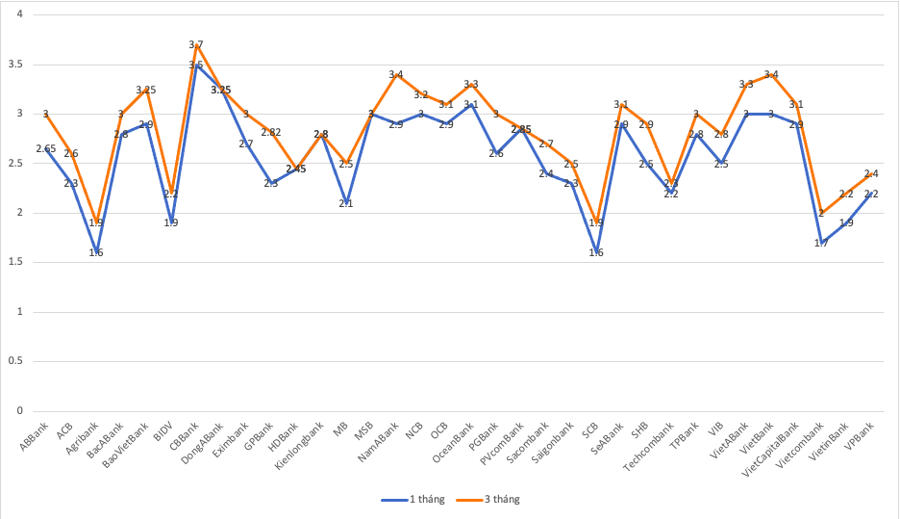

For 1-3 month terms, the average deposit interest rate of major private commercial banks (MB, ACB, VPBank, Techcombank) decreased by 0.2 percentage points from 2.53% per year to 2.33% per year. The average deposit interest rate of state-owned commercial banks (Agribank, BIDV, Vietcombank, Vietinbank) also decreased slightly by 0.02 percentage points, from 1.95% per year to 1.93% per year. The remaining commercial banks slightly reduced their deposit interest rates for 1-3 month terms from 2.96% per year to 2.87% per year.

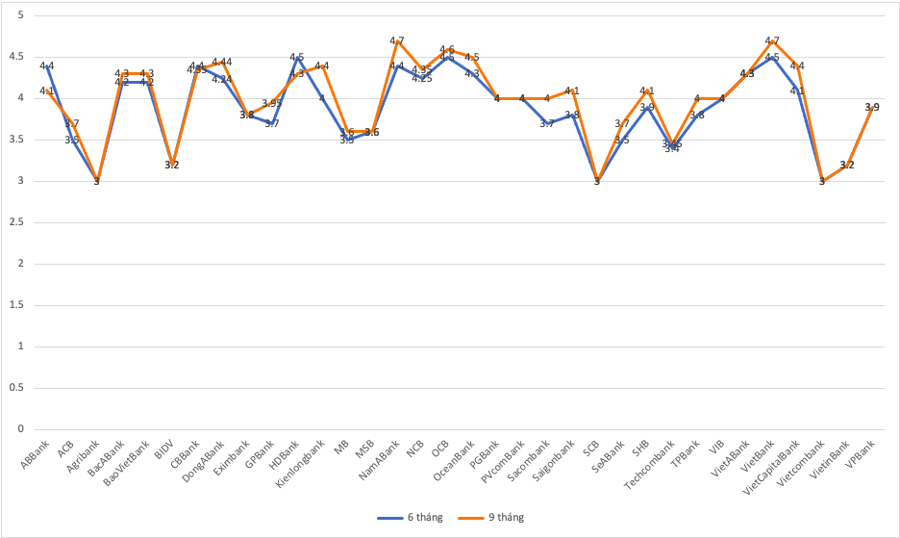

The average deposit interest rate for 6-9 month terms of major commercial banks decreased from 3.73% per year to 3.62% per year (a decrease of 0.11 percentage points). At this term, the deposit interest rate of the 4 state-owned commercial banks remained unchanged compared to the end of February 2024, still at 3.1% per year. For 6-9 month deposits, the remaining banks had an average interest rate of 4.1% per year, a slight decrease of 0.15 percentage points compared to the end of February 2024.

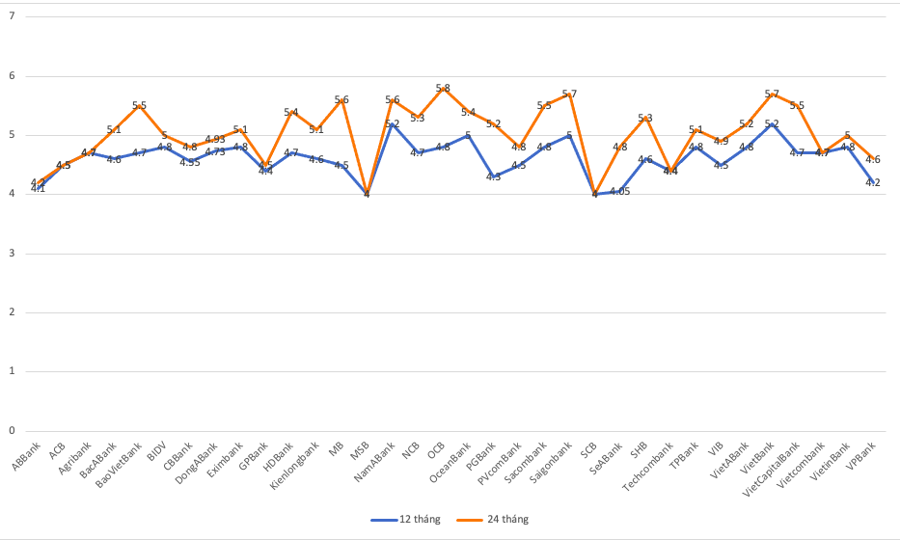

In contrast to short-term terms, the highest deposit interest rate for 12-month terms in the state-owned commercial banks system is 4.75% per year, while other banks are around 4.4% to 4.62% per year. At the 12-month term, the deposit interest rate also decreased from 0.03 percentage points to 0.15 percentage points compared to the end of February.

Going into details for each bank, the highest current 1-month saving interest rate is 3.5% per year, applied at CBBank. Next is DongABank with 3.25% per year, OceanBank with 3.1% per year, and then Quoc Dan (NCB), VietABank, VietBank, and Maritime Bank with 3% per year.

For 1-month deposits, the lowest interest rate is 1.6% per year, applied at Agribank, SCB, and Vietcombank, slightly higher at 1.7% per year. BIDV and Vietinbank both apply an interest rate of 1.9% per year for 1-month deposits.

The highest current 3-month saving interest rate is 3.7% per year applied at CBBank. Next is NamABank and VietBank with 3.4% per year. At this term, the lowest interest rate is 1.9% per year applied at Agribank and SCB.

The highest current 6-month saving interest rate is 4.5% per year applied at HDBank, OCB, and VietBank. An Binh Bank, CBBank, Nam A Bank have a slightly lower rate of 4.4% per year but still among the highest in the system. The lowest interest rate for a 6-month term is 3% per year applied at Agribank, SCB, and Vietcombank.

The 9-month saving interest rate is not significantly different from the 6-month term. VietBank and Nam A Bank currently have the highest 9-month saving interest rate in the system at 4.7% per year. Next is OCB with 4.6% per year.

Unusually, at An Binh Bank, the longer terms have lower interest rates compared to the 6-month term by 0.3 percentage points. Deposits for 9 months and 12 months at this bank still enjoy an interest rate of 4.2% per year.

The highest 12-month saving interest rate currently is 5.2% per year applied at Nam A Bank and VietBank. Next is OceanBank, SaigonBank with 5% per year. At this term, Agribank, BIDV, Vietcombank, Vietinbank apply interest rates from 4.7% – 4.8% per year, which are also high rates in the system. The lowest current 12-month saving interest rate is 4% per year at Maritime Bank and SCB.

For 24-month deposits, the highest interest rate is 5.8% per year at OCB. Next is SaigonBank, VietBank with 5.7% per year.

If customers make online deposits, they can enjoy higher interest rates compared to counter deposits, from 0.1% to 0.3% per year.

The above-mentioned deposit interest rates are for individual customers’ deposits, with the interest paid at the end of the term and subject to change. Banks have their own interest rate policies applied to different customer segments, depending on the deposit value.

In addition, actual deposit interest rates may vary depending on the capital balance situation of each bank branch…