Afternoon Panic Grips Vietnamese Stock Market as VN-Index Plunges Below 1,200

The feeble morning session quickly transformed into a state of panic this afternoon as investors abandoned their purchasing stance and were forced to sell at a loss. The VN-Index nosedived, breaching the 1,200-point mark for the second time, shedding 22.67 points or 1.86% at the closing bell.

The closing index marked the day’s lowest level, with hundreds of stocks following suit. This clearly reflects the intense selling pressure. While the VN-Index’s breadth at the end of the morning session remained relatively positive with 191 gainers against 227 decliners, the closing figures showed a stark contrast with only 137 gainers and a staggering 348 decliners. The morning session saw 84 stocks dropping over 1%, while this number surged to 162 by the end of the day.

Trading volume also witnessed a dramatic spike of 114% compared to the morning session, reaching VND 12,663 billion. While this level is not excessively high, it clearly demonstrates the shift in sentiment among stock-holding investors, who are heavily pressured to sell at significantly lower prices. The wide range of price declines coupled with low liquidity indicates a clear withdrawal of funds.

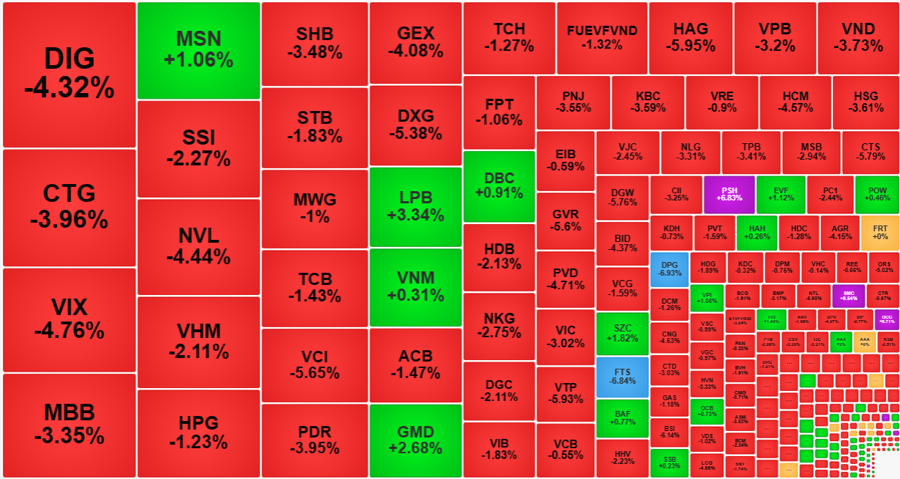

The downward trend was primarily driven by blue-chip stocks. The VN30-Index declined by 1.78%, with only four gainers while 26 stocks closed in the red. MSN gained 1.06%, POW rose by 0.46%, VNM edged up by 0.31%, and SSB increased by 0.23%. Notably, none of these gainers made it to the top 10 in terms of market capitalization, with VNM ranking 11th and MSN at the 15th position.

In contrast, the decline was pronounced among the top 10 stocks, with nine of them posting steep losses: BID (-4.37%), VHM (-2.11%), CTG (-3.96%), GAS (-1.18%), VIC (-3.02%), HPG (-1.23%), TCB (-1.43%), VPB (-3.2%), and FPT (-1.06%).

The immense selling pressure is also evident in the distribution of trading volume: Over 77% of the total trading value on the Ho Chi Minh Stock Exchange (HoSE) today was concentrated in stocks that declined by more than 1%. Notably, stocks falling by 2% or more accounted for 60% of the liquidity. The most heavily sold stocks were DIG (-4.32% with VND 785 billion in liquidity), CTG (-3.96% with VND 634.5 billion), VIX (-4.76% with VND 563.5 billion), MBB (-3.35% with VND 562.2 billion), NVL (-4.44% with VND 480.4 billion), SHB (-3.48% with VND 366 billion), VCI (-5.65% with VND 322.6 billion), GEX (-4.08% with VND 309.8 billion), and DXG (-5.38% with VND 304.4 billion). Out of the 47 stocks on HoSE with liquidity exceeding VND 100 billion, 42 ended in the red, with 32 of them dropping over 2%.

Curiously, the list of gainers today featured several highly speculative stocks, with 11 reaching their daily漲停板 (maximum daily trading range). While most of these stocks had very low liquidity, raising concerns about the sustainability of their price increases, a few notable exceptions included PSH traded VND 82.9 billion, QCG traded VND 23.2 billion, and SMC traded VND 34.1 billion. Other non-conformist stocks attracted decent liquidity but more modest gains: LPB (+3.34% with VND 302.4 billion), GMD (+2.68% with VND 278.5 billion), SZC (+1.8% with VND 95.7 billion), EVF (+1.12% with VND 79.6 billion), and MSN (+1.06 with VND 485.5 billion).

Despite the afternoon surge in trading activity, the total market liquidity for the entire day remained at its lowest in the past four sessions, reaching VND 18,586 billion on the two exchanges excluding agreement transactions. If this liquidity level had been accompanied by price stability, it could have signaled an easing of selling pressure. However, the wide range of price declines indicates that buyers were unwilling to support prices, accepting only very low levels. This decline is putting significant pressure on investors who aggressively bought the dip yesterday, as the risk of incurring losses upon stock delivery is substantial.

Foreign investors maintained their strong selling momentum this afternoon, offloading an additional VND 1,513.2 billion, representing a 35% increase compared to the morning session. The net selling value amounted to approximately VND -464 billion. In the morning session, foreign investors had sold VND 523.4 billion worth of stocks. Thus, their total net selling for the entire day reached VND 987 billion. This brings the total net foreign selling on the HoSE since the beginning of the week to over VND 2,000 billion.