HCD supplies raw plastic materials, construction materials, and products made from wood plastic (also known as composite wood, a synthetic material made from wood flour and plastic). The company is behind the HCDWood brand and its products include flooring, cladding, and multi-purpose wood plastic beams.

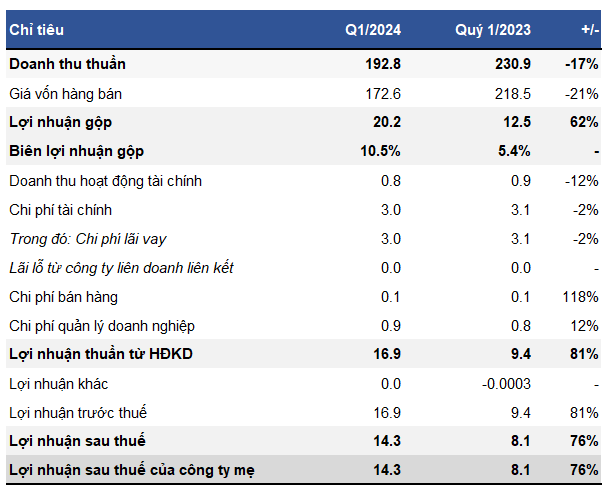

In the first 3 months of the year, HCD continued the positive growth momentum from previous quarters. Specifically, the company recorded a sharp 76% increase in net profit to over VND 14 billion, despite a decline in revenue.

A strong increase in gross profit margin was the main factor behind HCD‘s positive business results, possibly due to the company reducing the proportion of the trading segment and gradually increasing the proportion from the wood plastic business. In the first quarter of 2024, the gross profit margin was 10.5%, while in the same period last year it was only 5.4%.

The negative point in this report is the increase in selling and general and administrative expenses, which increased by more than VND 100 million and VND 900 million, respectively.

HCD’s Business Results for Q1 2024

Unit: Billion VND

Source: VietstockFinance

|

After the information about the Q1/2024 report, HCD shares increased by more than 4% during the session on April 19, but then decreased following the general market trend.

Plan for 17% growth in after-tax profit

Looking ahead, the company plans to continue reducing sales in the trading business, focus on investment and development, and increase sales in the outdoor wood plastic manufacturing sector.

In the document prepared for the annual general meeting of shareholders to be held on April 26, HCD set a target of VND 920 billion in net revenue in 2024, a slight increase compared to the previous year, while after-tax profit is expected to reach nearly VND 61 billion, an increase of more than 17%. After the first quarter results, the company has achieved 23% of its after-tax profit plan.

Regarding the dividend distribution plan, the company plans to pay a 13% stock dividend for 2023 and not less than 12% for 2024.

Private placement of 25 million shares at a price of VND 10,000

In addition to the business plan, the owner of the HCDWood brand also plans to raise additional capital for business and investment activities.

The company plans to issue 25 million shares in a private placement to less than 100 professional and strategic investors. Notably, the expected selling price is VND 10,000, higher than the current market price (VND 9,700/share).

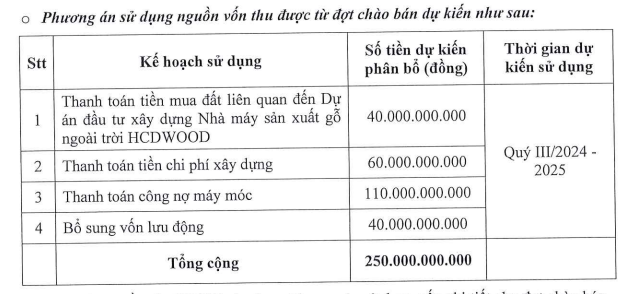

About VND 250 billion of the proceeds will be used to pay for land related to the HCDWood outdoor wood manufacturing plant investment project, pay for construction costs, pay off machinery debts, and supplement working capital.

These shares are expected to be subject to trading restrictions for 1 year for professional investors and 3 years for strategic investors from the date of completion of the offering. The company plans to implement this in 2024 or at another time as decided by the Board of Directors after approval by the State Securities Commission.