Vietcap Securities Corporation (VCI) has just released its first-quarter financial report with revenue reaching VND 806 billion, an increase of more than VND 300 billion compared to the same period last year.

Key revenue streams all experienced strong growth. The main contributor to revenue in the quarter was profit from the sale of financial assets (FVTPL), reaching VND 338 billion – double that of the same period last year. Lending and brokerage activities each contributed more than VND 180 billion.

After deducting expenses, Vietcap achieved VND 227.5 billion in pre-tax profit in the past quarter, nearly 2.8 times higher than the VND 80.8 billion in the same period last year.

This year, according to the plan approved by the General Meeting of Shareholders, the company aims to achieve VND 2,511 billion in revenue and VND 700 billion in pre-tax profit. Thus, after the first quarter, Vietcap has completed 32% of its revenue and profit plans.

At the end of the first quarter, Vietcap’s total outstanding loans reached VND 8,573 billion, an increase of more than VND 570 billion compared to the end of 2023. Of which, outstanding margin loans reached VND 8,419 billion.

Also in the past quarter, Vietcap’s brokerage market share on HoSE increased by nearly 1 percentage point to 5.97% – the brokerage with the strongest increase in market share compared to the fourth quarter of 2023.

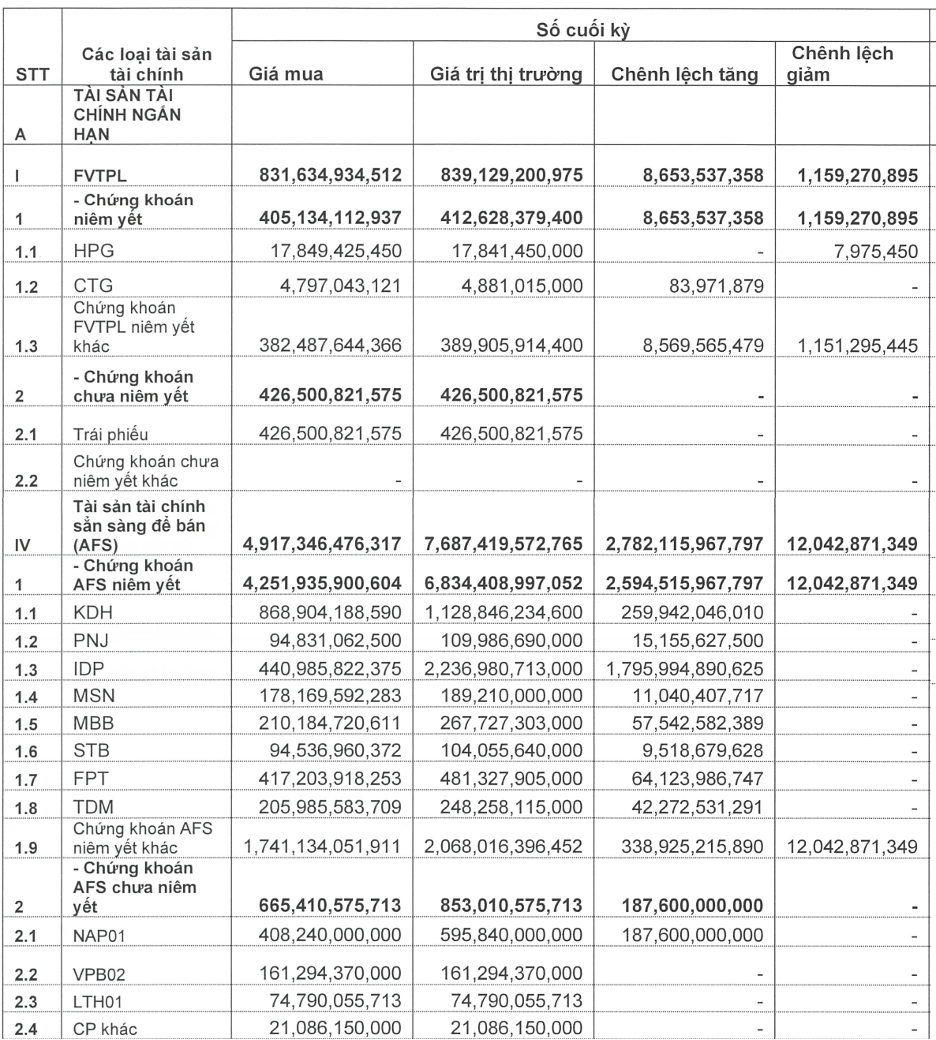

As of March 31, 2024, Vietcap held a portfolio of listed stocks with a market value of over VND 7,200 billion, mainly classified as financial assets available for sale (AFS) with over VND 6,800 billion – an increase of nearly VND 2,600 billion compared to the purchase price.

The largest current investments include IDP (VND 2,236 billion), Khang Dien – KDH (VND 1,129 billion), FPT (VND 481 billion), MBB, TDM, etc. Compared to the end of last year, FPT is the stock that has been invested in the most, with the original investment value increasing from VND 175 billion to VND 417 billion.