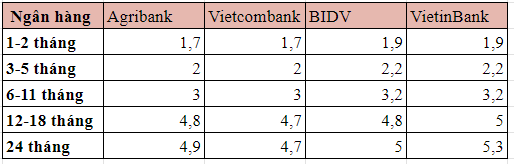

Starting from today (January 31, 2024), Agribank officially applies the new deposit interest rates. Previously, on January 17, the bank also adjusted down the savings interest rates.

Specifically, for terms of 1 to 3 months, the interest rate will be at 1.7% per annum, a decrease of 0.1 percentage points compared to the previous adjustment. Meanwhile, for terms from 3 to 5 months, the savings interest rate is reduced to 2% per annum, also a decrease of 0.1 percentage points.

The interest rate for terms from 6 months to under 12 months is reduced by 0.2 percentage points to 3% per annum. The deposit interest rate for terms from 12 months to under 24 months is reduced to 4.8% per annum, a decrease of 0.2% compared to the previous interest rate table.

For terms of 24 months and above, the current applied interest rate is 4.9% per annum, a decrease of 0.4% compared to the previous interest rate table.

Savings interest rates at the Big 4 banks as of January 31.

According to the survey, the adjusted interest rate for terms under 12 months at Agribank has dropped and is now equal to Vietcombank. Meanwhile, the interest rate for terms under 12 months at BIDV and VietinBank is slightly higher by 0.2 percentage points compared to Agribank and Vietcombank.

For terms of 12-24 months, the deposit interest rate at Vietcombank is the lowest among the Big 4 banks, staying at 4.7% per annum. VietinBank has the highest interest rate in this term, with the current deposit interest rate at 5-5.3% per annum.

Meanwhile, the deposit interest rate at BIDV for terms of 12-18 months and 24 months is 4.8% and 5% per annum, respectively.