Warren Buffett’s wisdom is once again proven by his investment in Japan, despite the Asian economy being in a recession and losing its position as the world’s third largest economy to Germany.

Risky Move

In 2023, Warren Buffett’s Berkshire Hathaway announced a $6 billion investment portfolio in 5 Japanese companies, starting from the summer of 2020.

This information has made many Berkshire shareholders concerned as the Japanese economy has been facing numerous difficulties.

Since reaching its peak on December 29, 1989, the Japanese stock market has plummeted by 60% in value within a few years. The burst of the economic bubble led to decades of deflation, slow growth, and even being called the “Lost Decade.”

Up until now, the Japanese economy has not completely recovered from the troubles it faced, entering a technical recession in the past quarter (two consecutive quarters of negative growth) with a GDP decrease of 0.4%.

Furthermore, Japan’s loss of the position as the world’s third largest economy to Germany has raised more concerns for Warren Buffett’s investment.

The weakening yen has eroded Japan’s import sources for raw materials, while also affecting domestic consumption heavily relying on energy, food, and essential goods from abroad.

What’s worse, Japan’s population has been declining for 14 consecutive years, damaging its workforce and consumer demand.

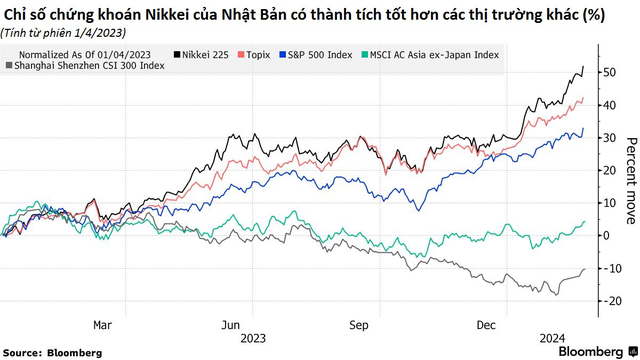

However, once again, the 93-year-old investor Warren Buffett has proved himself right. The Nikkei 225 index of the Japanese stock market reached a record high on February 22, 2024.

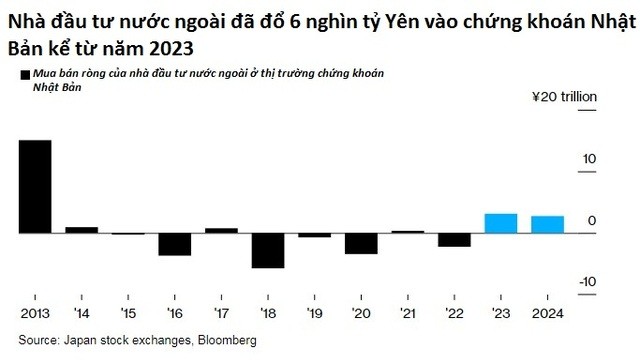

Bloomberg reported that foreign capital had been moving out of the Japanese stock market for 6-8 years until 2022. However, this trend has shifted since the beginning of 2023 with a strong influx of capital.

According to Fortune, foreign investors began to follow in the footsteps of Warren Buffett when they witnessed Berkshire’s profits from investing in Japan despite the difficulties of the economy.

The positive performance of Japanese companies’ businesses has reassured foreign investors to pour their money into Japan and follow Buffett’s lead, creating a record-breaking stock market despite negative signals from the economy.

Tempting Opportunities

Fortune stated that Berkshire Hathaway, which prefers American brands like Apple and Coca-Cola, has also been attracted by the optimistic investment returns in Japan.

Even Charlie Munger, Warren Buffett’s right-hand man who passed away in late 2023, admitted that this money-making opportunity was too juicy to resist.

“If you’re as smart as Warren Buffett, you’d realize this is an opportunity that comes once every 2-3 centuries,” said Charlie Munger.

“Interest rates in Japan are very low, and most companies here are long-established businesses. These companies have cheap copper mines and rubber plantations. Therefore, you can borrow money for a 10-year term to buy stocks with an average dividend of 5% per year. It’s a massive cash flow that doesn’t require much capital investment or much thought but still yields profits,” added Warren Buffett’s right-hand man.

In simple terms, Berkshire can currently raise funds for its investments at extremely low borrowing costs due to negative interest rates. It then pours this money into reliable stocks with stable dividends and long-term returns without much consideration.

Reports show that Berkshire has increased its stake in 5 Japanese companies from 5% in August 2020 to 7.4% in April 2023.

This risky move in the midst of Japan’s economic downturn has helped Buffett become a pioneer in benefiting from the current surge in the country’s stock market.

Indeed, Louis Kuijs, the chief economist at S&P Global Ratings in the Asia-Pacific region, believes that the record-high profitability of Japanese companies has strongly attracted foreign investment, overshadowing the “Lost Decade” narrative and other negative signals.

Last month, Toyota set a new record for the highest market capitalization of a Japanese company, reaching 48.7 trillion yen, equivalent to 323.5 billion USD, surpassing NTT’s previous record in 1987.

According to estimates, Toyota’s total value is currently around 57.5 trillion yen, equivalent to 381.6 billion USD, much higher than NTT’s 16.4 trillion yen (108.6 billion USD).

New York Times reported data from the Japan Exchange Group showing that foreign investors continued to pump a net 14 billion USD into the Japanese stock market in January 2024.

Similarly, a Goldman Sachs report showed that Japanese companies’ income in Q4 2023 increased by 45% compared to the same period the previous year, thanks to the weak yen, making exports more competitive.

Encouraging Changes

Fortune suggests that in addition to the weakening yen, the Japanese companies’ reorganization of their Keiretsu organizational system, rationalizing complex structures, has made the market more attractive to foreigners.

Keiretsu is a common business model in Japan, representing a network of various companies including manufacturers, supply chain partners, distributors, and occasionally financial companies. They work together, have close relationships, and sometimes own small shares of each other while operating independently.

Herald van der Linde, the head of strategy at HSBC, described Japan’s Keiretsu model as a bowl of ramen with low return on capital, low dividends, and a few instances of share buybacks.

This lack of dynamism was strikingly reflected in the Global 500, the list of the world’s largest companies by revenue.

Since its first ranking in 1995 until now, the number of Japanese companies appearing on the list has decreased significantly.

The most recent Japanese company to enter the list was Toyota Tsucho, maintaining its position for 15 years but still in the lower half of the rankings.

However, according to Morgan Stanley, Japanese companies are changing to become more dynamic, aiming for record profits and becoming more attractive to foreign investors.

The Tokyo Stock Exchange has also undergone significant changes, requiring companies to reform more to increase profitability and tightening control over Keiretsu relationships between parent and subsidiary companies.

In January 2024, the Tokyo Stock Exchange even stated that it would publicly list the names of companies with harmful restructuring plans, making them ashamed. It would also delist underperforming companies by 2026.

Bright Future

According to Bloomberg, Warren Buffett’s investment in Japan is very risky as private consumption fell by 0.2% in Q4 2024, while business investment also decreased by 0.1% during the same period.

Japan’s average age is 49.1 years, higher than 38.1 in the US, and the Tokyo government is facing major labor shortages as it is reluctant to accept too many foreign workers into the market.

However, many economic experts remain optimistic, believing that the Japanese economy is showing signs of recovery. Several companies such as Toyota, Nintendo, and Uniqlo raising wages will stimulate other businesses to follow suit, thereby boosting consumer demand.

In addition, the expectation that Japan will raise interest rates for the first time since 2007 has also made investors anticipate the normalization of the country’s monetary policy.

According to S&P Global Ratings’ Kuijs, Japan’s average GDP per capita growth rate and labor productivity are not bad, and the economy has the potential to gradually recover, even though the GDP growth rate may not be exceptionally high.

Source: Fortune, Bloomberg