Investors often pay attention to dividends, especially cash dividends, when choosing to hold stocks. This is considered an important benefit for shareholders and is often the deciding factor for whether shareholders stay with the company for the long term or not.

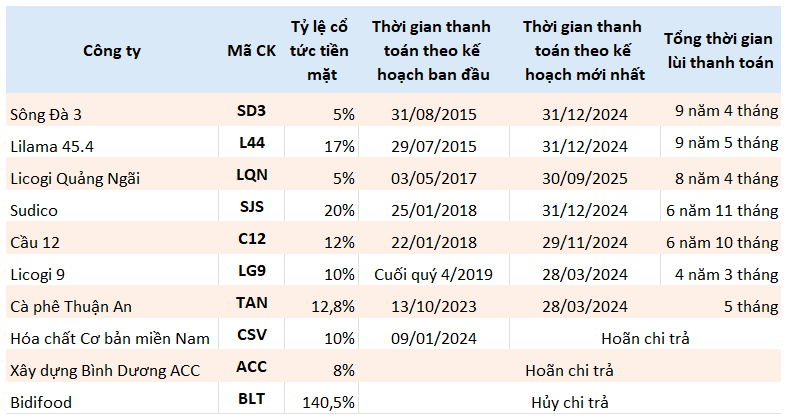

However, announcing a cash dividend record date does not necessarily mean that investors can rest assured. Statistics show that there are many companies that delay dividend payments, continuously extending the payment period, some for up to a decade. This delay turns the eagerly anticipated moment of receiving cash dividends into a feeling of disappointment, frustration, and anger.

One of the names that many investors mention when discussing delayed dividend payments is Sudico Investment and Industrial Development Corporation (Sudico, code SJS). Most recently, the company’s Board of Directors approved the extension of the payment time for dividends for 2016 and 2017 with a total rate of 20% in cash from June 30, 2023 to December 31, 2024. This is the 9th time the company has delayed the payment of dividends for 2016 and the 5th time for the 2017 dividends.

The reason given is still “familiar” when it states that the financial situation is difficult and the company has not arranged the necessary funds. A total of SJS shareholders have been waiting for nearly 7 years, and the dividends still haven’t reached their hands.

However, this is not the longest overdue dividend. At Song Da 3 Joint Stock Company (code SD3), the company has just announced the postponement of the payment of dividends for 2015 to December 31, 2024. The dividend rate is 5%, equivalent to an amount of approximately VND 8 billion. In the first announcement, SD3 was scheduled to pay dividends on August 31, 2015, but until now, the time has been extended for an additional 9 years and 4 months.

In the latest announcement, SD3 stated that due to the investor not having arranged the funds for payment, the cash flow cannot meet the needs of dividend payment as planned.

Similarly, at Licogi Quang Ngai (LQN), the company has recently “extended” the dividends for shareholders for an additional 2 years, from September 29, 2023 to September 30, 2025. The company has changed the dividend payment time more than 10 times, with a total delay of over 8 years since the first payment announcement.

In the latest document, LQN stated that they have tried to work with partners to obtain the funds, however, due to the prolonged difficult situation, the expected receivables from partners did not materialize as expected, requiring more time to balance the cash flow.

Many other companies are also relatively slow in paying dividends to shareholders such as Cau 12 Joint Stock Company (nearly 7 years), Licogi 9 (more than 4 years), and Thuan An Coffee (5 months). There are even exceptional cases where payment of dividends was cancelled at Binh Dinh Food Joint Stock Company (Bidifood, BLT).

Initially, BLT planned to pay dividends for 2022 in cash at a rate of 170.5%, equivalent to VND 17,050 for every share owned, with a total estimated expenditure of over VND 6.8 billion. BLT made a payment to shareholders at a rate of 30% in cash, equivalent to VND 1.2 billion, in June 2023. However, they then stopped paying the remaining dividends of 140.5%, leaving shareholders disappointed.

BLT stated that the company’s financial situation is currently very difficult, with no capital to pay the remaining portion of the dividend. The reason is that the cost of goods has increased by over 50% since July, with the average price of rice exceeding VND 15,500/kg, and BLT needs to maintain a stock reserve of over 3,000 tons of rice worth VND 4.6 billion, leading to limited capital sources, reduced capital utilization efficiency, and increased borrowing costs.

In general, delayed dividend payments by companies are related to financial difficulties and insufficient cash flow. For example, at SD3, although they had a net profit of nearly VND 8 billion in 2023, the company is still accumulating losses of nearly VND 231 billion.

L44 also accumulated losses of nearly VND 196 billion at the end of 2022, and their shares are currently restricted from trading due to late submission of 2022 audited financial statements and negative equity on the 2021 audited financial statements.

Or at Licogi Quang Ngai, in addition to delaying dividend payments, the company has also owed salaries and social insurance to employees for a long period of time. Since being listed on UPCoM, Licogi Quang Ngai has recorded losses for 3 consecutive years from 2020 to 2022. As of December 31, 2022, Licogi Quang Ngai’s accumulated losses exceeded VND 29 billion, resulting in negative contributed capital of over VND 7 billion.