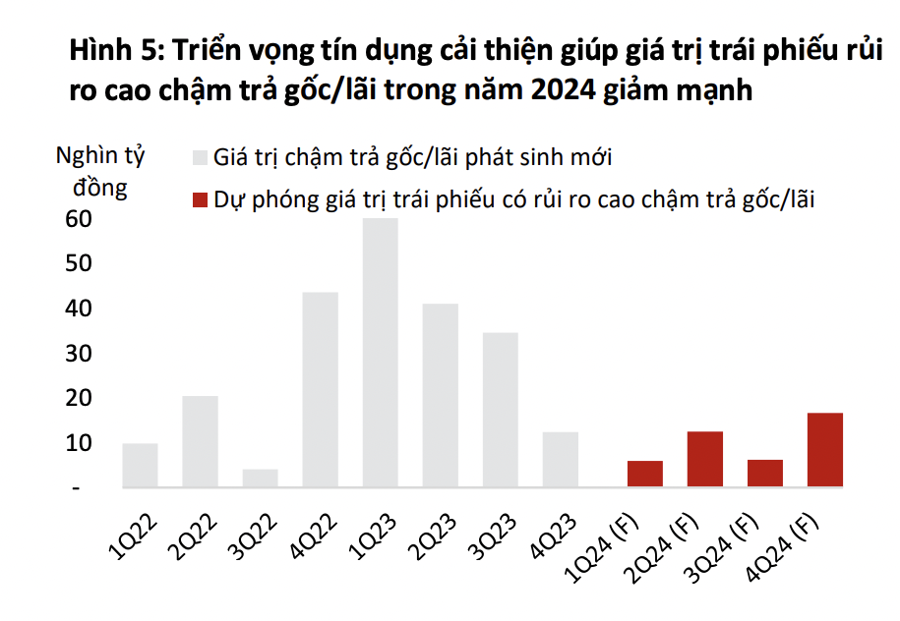

The value of newly delayed bonds has significantly decreased to less than 5 trillion VND per month in Q4 2023. As of December 2023, the industry group with the highest default rate is Real Estate, Construction, and Energy due to the decline in the real estate market and delays in the commercial operation of renewable energy projects. However, the default rate has started to decline slightly compared to the peak in October 2023, according to Vis Ratings.

Many issuers have negotiated with bondholders to amend the terms and extend the bonds to 2024 or 2025, especially issuers in the Real Estate, Construction, and Energy industry group.

A total of 175 bond issuances with a face value of 59 trillion VND with maturity dates in 2023 have been extended, accounting for 14% of the total bond value due in 2023. The average extension period of these bonds is 20 months, close to the maximum extension period of 2 years according to Decree 08/2023/NĐ-BTC (Decree 08).

Bonds with high default risk that will be delayed in paying principal/interest in 2024 amount to 40 trillion VND, accounting for 19% of the total bonds due in 2024. This figure is significantly lower than the 147 trillion VND of bonds with delayed principal/interest occurring in 2023.

This downward trend is due to improved cash flows from business activities and increased access to new sources of finance, especially for industry groups with high default rates such as Real Estate, Construction, and Energy, thanks to supportive policies and a low-interest rate environment.

About 40 trillion VND of high-risk bonds come from 35 issuers, mostly real estate and construction companies. Overall, these companies have a very weak debt-paying ability, as evidenced by a very high debt/equity ratio, insufficient cash resources/face value of matured bonds, and low earnings before interest, tax, depreciation, and amortization (EBITDA) compared to other issuers.

Additionally, 17 out of 35 high-risk issuers (accounting for about 61% of the value of defaulted principal/interest bonds) are SPEs established solely for capital mobilization purposes, while almost having no revenue and cash flows from business activities. These SPEs are related to 6 major corporate groups, 3 of which have experienced delayed principal/interest payments on other bonds.

VIS Ratings believes that the value of new bond issuances will continue to recover in 2024 as the corporate bond market enters a new development cycle.

The significant new issuances from the Banking sector will continue to contribute the majority of the issuance value in 2024. New issuances from the Banking sector accounted for 60% of the total newly issued corporate bonds in 2023. Stricter regulations on the short-term capital ratio for medium- and long-term loans will encourage banks to issue more bonds to supplement their long-term capital structure.

In addition, banks typically issue new bonds annually to compensate for the amount of bonds repurchased and matured in the year. In a low-interest rate environment, banks will have an incentive to repurchase and issue bonds with more attractive interest rates.

The recovery of corporate bond issuances from Real Estate companies will also contribute to the recovery of new corporate bond issuances in 2024. The capital demand by Real Estate companies is expected to be higher in 2024 as legal barriers are reduced and project licenses are restored, with real estate laws taking effect from 2024 onwards. This can be seen through the recovery of the value of Real Estate bond issuances in the second half of 2023.