On March 4, Novagroup Joint Stock Company announced that it has sold 4.4 million NVL shares of No Va Real Estate Investment Joint Stock Company (Novaland) to balance its investment portfolio and support the company’s debt restructuring. Thus, Novagroup has reduced its ownership in Novaland to 362.9 million shares, equivalent to 18.608% of the capital and remains the largest shareholder of this enterprise. Based on the market price on March 4, Novagroup earned a total of VND 77 billion from selling NVL shares.

Previously, from February 2 to 5, Novagroup sold 12.4 million NVL shares, reducing its ownership to over 367 million shares. Based on the average closing price, the estimated transaction value of this deal is approximately VND 211 billion.

Therefore, in the first quarter of this year, Novagroup has earned nearly VND 300 billion from selling NVL shares to support Novaland’s debt restructuring.

Alongside Novagroup, Diamond Properties Joint Stock Company has also registered to sell 4 million NVL shares of No Va Real Estate Investment Joint Stock Company (Novaland). The transaction is expected to be executed from February 26 to March 26 through matching orders and/or agreements. If completed, Diamond Properties will reduce its ownership in Novaland to 171.4 million units (8.79% of the capital).

Both Novagroup and Diamond Properties are organizations related to Mr. Bui Thanh Nhon – Chairman of Novaland’s Board of Directors.

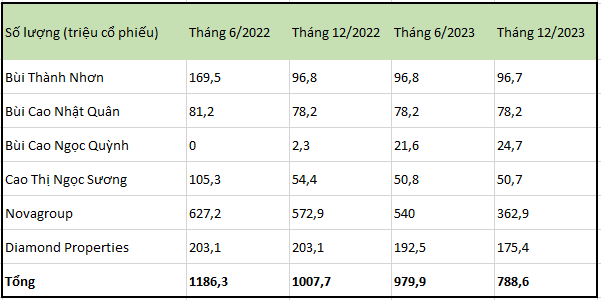

Shareholders associated with Mr. Nhon are gradually losing their ownership percentage due to being sold under collateral, although the quantity is less than the previous period. Currently, the group of shareholders related to the Novaland Chairman’s family still holds about 788.6 million NVL shares (40.44% of the capital).

Back in June 2022, before the incident of NVL shares continuously plummeted for 17 consecutive sessions, this group of shareholders held nearly 1.19 billion NVL shares (60.85% of the capital). Therefore, within just two years, about 397.7 million NVL shares (20.4% of the capital) have slipped out of the hands of Mr. Bui Thanh Nhon and associated shareholders.

As of December 31, 2023, Novaland’s financial debt reached VND 57.704 trillion, a decrease of nearly VND 7,000 billion compared to the beginning of the year. Among them, bond debt is VND 38.262 trillion, a decrease of VND 5,900 billion. Bank debt is VND 9.400 trillion.

Recently, Novaland has also announced a request to delay the interest payment for 4 bond lots on February 28 with the reason “not yet able to arrange payment sources on time”. The total projected interest to be paid for these 4 lots is nearly VND 98 billion. NVL stated that it plans to make the payment on March 8.