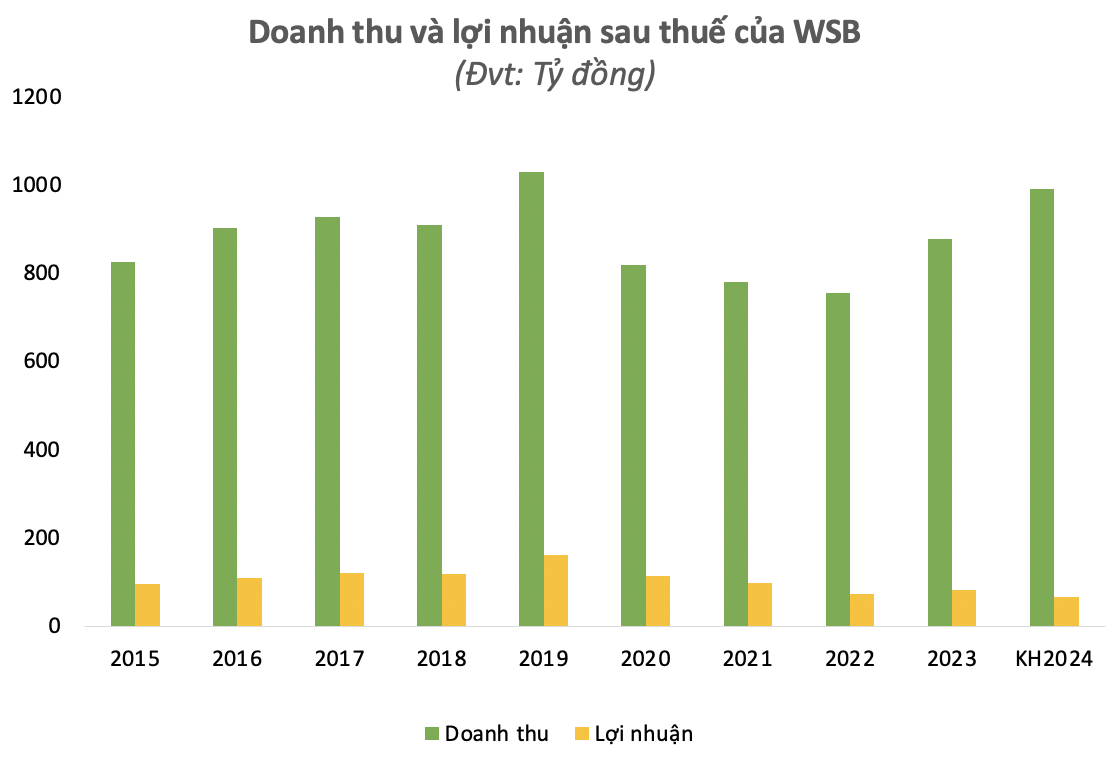

Saigon – Mekong Beer Joint Stock Company (WSB code) has just announced the annual shareholders’ meeting 2024 document with a revenue plan of 990 billion VND, an increase of 13% compared to the same period. However, the expected after-tax profit is only about 66 billion VND, 21% lower than the previous year’s performance. If the set plan is correct, this will be the lowest net profit in 11 years of Saigon – Mekong Beer.

The cautious business plan is put forward in the context of the company predicting the economy in 2024 will still face many difficulties when raw material prices rise due to the impact of the disease, as well as political tension and the risk of economic recession still exist, and consumer demand is slow to recover.

In 2023, WSB recorded revenue and profit of nearly 878 billion VND and 83 billion VND, respectively, an increase of 15% and 16% compared to the same period last year. Although the revenue last year did not meet the plan, the profit was 32% higher than the previous target.

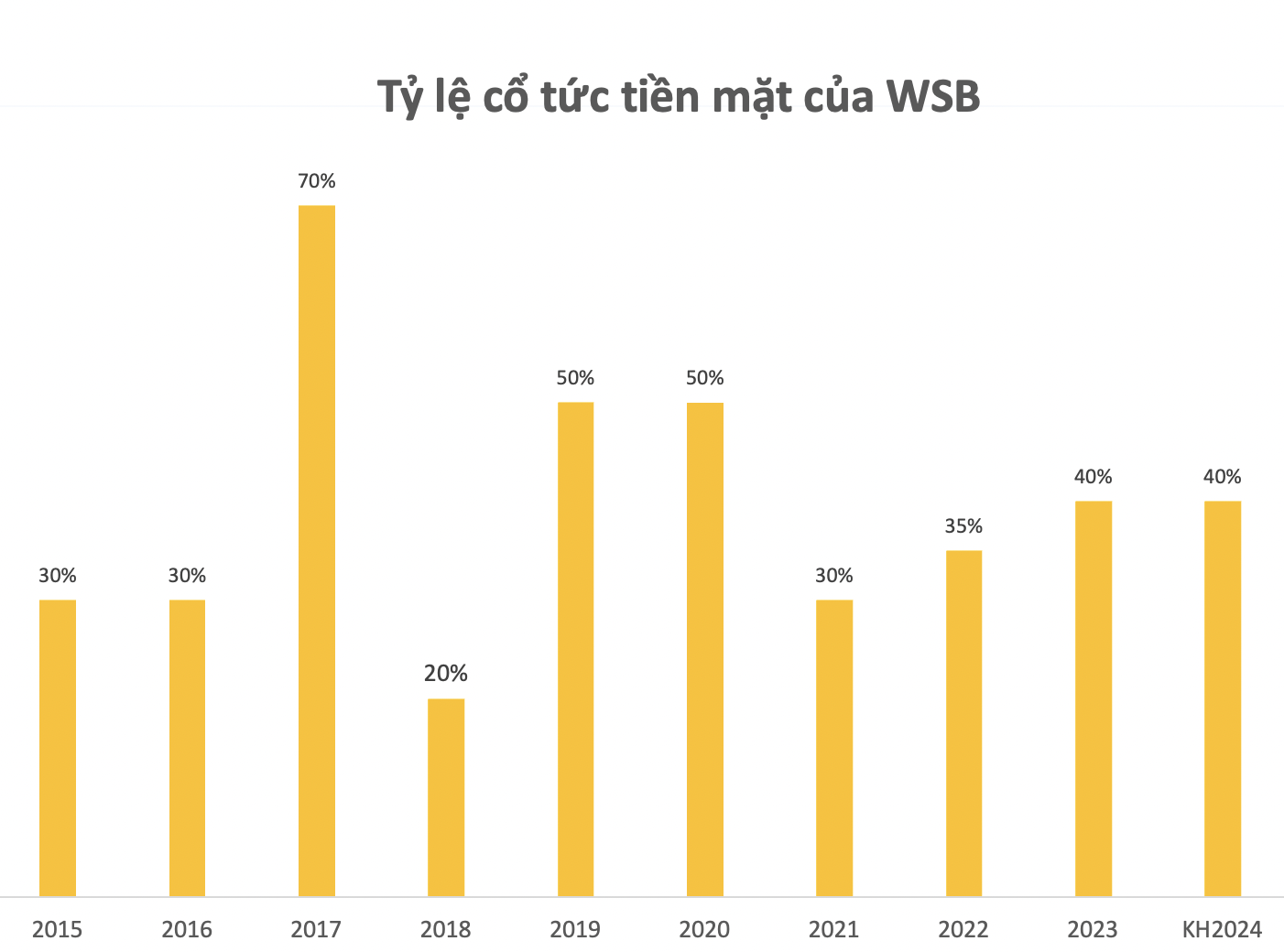

With the achieved results, the company proposed a dividend distribution of 40% in cash for 2023 – higher than the 30% plan through the early repayment this year. In which, WSB has advanced a dividend payment of 10% in December 2023. Therefore, the company still has a dividend payout of 30% for 2023, but the specific time has not been announced.

WSB is a company that has a history of cash dividend payment annually to shareholders since it was traded on UPCoM in 2010. The peak was the year 2017 with a cash dividend payout ratio of up to 70%, and the 2019-2020 period also maintained 50% each year. In recent years, the company has regularly paid cash dividends with a rate of over 30%. Regarding the 2024 plan, the company plans to maintain a dividend ratio of 40% in cash.

Saigon – Mekong Beer Joint Stock Company was established in 2006 based on the merger of two units: Saigon – Can Tho Beer Joint Stock Company and Saigon – Soc Trang Beer Joint Stock Company. In 2010, shares of Saigon – Mekong Beer Joint Stock Company were officially traded on UPCOM with the stock code WSB.

In the shareholder structure of WSB, Saigon Beer – Alcohol – Beverage Corporation (Sabeco, code SAB) is the parent company holding 70.55% of the capital, followed by AFC Vietnam Fund holding 7.22%. With the above ownership ratio, the majority of dividend money will flow into the pocket of the parent company Sabeco.

In the market, WSB shares have been fluctuating around the 51.x price range for over half a year. Due to low liquidity, the trading volume is often a few thousand units, and there are even sessions with no trading activity.