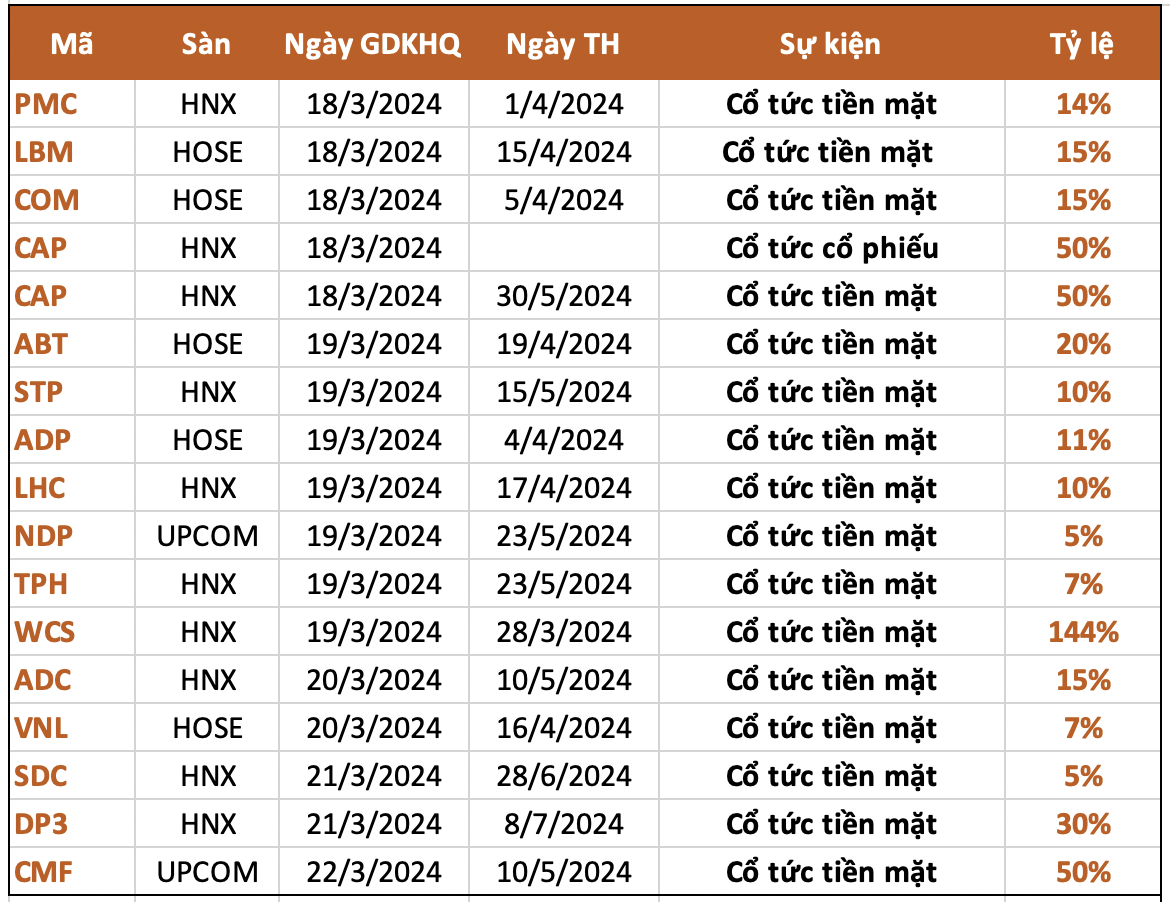

According to statistics, there were 16 companies announcing dividend settlements in the week of March 18 – 22, of which 15 companies paid dividends in cash and 1 company paid dividends in a combination of cash and shares. The percentage of companies paying cash dividends this week is quite high, with 8 companies paying dividends over 15%, the highest being 144% and the lowest being 5%.

Western Bus Corporation (WCS) announced the record date for shareholders to receive interim dividends for 2023 is March 20, 2024. WCS is expected to pay interim dividends in cash at a rate of 144% (1 share will receive 14,400 VND). The company will pay shareholders on March 28th.

Therefore, with 2.5 million outstanding shares, it is estimated that Western Bus Corporation will spend 36 billion VND to pay interim dividends to shareholders. It is known that the 2023 Annual General Meeting approved the payment of dividends for 2023 with a rate of no less than 20%. Thus, with this interim dividend payment, WCS has paid dividends in cash that exceed the plan by more than 7 times.

On March 19, Yen Bai Agricultural and Food Joint Stock Company (CAP) will record the list of shareholders to implement the 2022-2023 annual dividend payment with a total rate of 100%. Accordingly, 50% will be paid in cash (equivalent to 5,000 VND/share) and 50% will be paid in shares (owning 100 shares will receive an additional 50 new shares).

With over 10 million outstanding shares, CAP will spend over 50 billion VND to pay shareholders and issue over 5 million shares to pay dividends this time. After completion, the company’s charter capital will be increased to nearly 151 billion VND.

In this payment round, the group of shareholders related to CAP’s Chairman of the Board of Directors, Truong Ngoc Bien, will receive about 14 billion VND with a total ownership percentage of 28.32%. Currently, Ms. Hoang Thi Binh, a Member of the Board of Directors of CAP and also the wife of Mr. Bien, is the largest shareholder in the company with 11.82% ownership.

On March 22, Cholimex Food Joint Stock Company (Cholimex Food, CMF) will record the list of shareholders to implement the 2023 interim dividend payment in cash at a rate of 50%, equivalent to 5,000 VND/share.

With 8.1 million outstanding shares, Cholimex Food is expected to spend about 40.5 billion VND to pay shareholders. The company is expected to make the payment on May 10, 2024.

Since going public (2016), Cholimex Food has never forgotten to pay dividends in cash to shareholders. Especially, if the payment to shareholders is completed in May this year, this will be the 5th consecutive year from 2019-2023 that the company pays dividends at a rate of 50% (5,000 VND/share). Prior to that, in 2016 and 2017, the company paid dividends in cash with the same rate of 20%, and in 2018, the rate was 30%.

On March 22, Central Pharmaceutical Joint Stock Company No. 3 (Foripharm, DP3) will record the list of shareholders receiving the 2023 interim dividends at a rate of 30%, equivalent to 3,000 VND/share. The expected implementation date is July 8. With nearly 21.5 million outstanding shares, Foripharm is expected to spend nearly 65 billion VND to fulfill its obligation to shareholders.

This is a relatively low dividend distribution rate compared to the normal rate of the company in the past 5 years. During that time, the dividend distribution rate of Central Pharmaceutical Joint Stock Company No. 3 ranged from 50% to the highest rate of 80%.