In order to unlock Vietnam’s debt capital market, including corporate bonds, many experts argue that solutions should not only focus on the supply side but also stimulate the demand side by expanding the investor base both domestically and internationally.

THREE FACTORS AFFECTING FIRMS’ CAPITAL ABSORPTION CAPACITY

At the Vietnam Debt Market Conference 2024 jointly organized by FiinRatings and CGIF in Hanoi recently, experts said that numerous projects have been disrupted or delayed in the past two years. However, with several positive policy changes and the initial recovery of many sectors, projects will be accelerated in the coming period, leading to a huge demand for capital from businesses in the next 2-3 years.

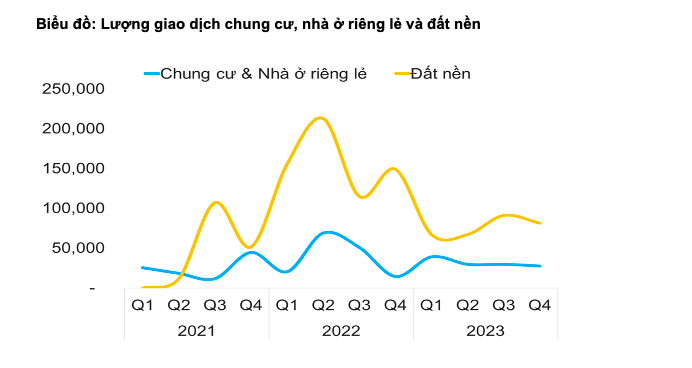

Taking the residential real estate sector as an example, according to statistics from the Ministry of Construction, the number of newly licensed projects is very limited, while the number of projects under development is at a record high. This will lead to a great demand for capital for project implementation, especially when the legal and policy framework is becoming clearer.

Or in the renewable energy sector, Mr. Abhishek Dangra, Executive Director, S&P Global Ratings said that the investment demand is up to 135 billion USD in the 2021-2030 period and 400 billion USD in the 2030-2050 period. This is a very large figure, in the context of GDP at 409 billion USD (in 2022).

In other sectors such as transport infrastructure, FiinRatings said that the capital demand is estimated at around 25-30 billion USD per year in the next 10 years.

However, one of the challenges for real estate and infrastructure businesses is that their capital absorption capacity is not high.

Talking to VnEconomy reporter, Mr. Nguyen Nhật Hoàng, Head of Corporate Credit Ratings at FiinRatings pointed out three main reasons affecting the capital absorption capacity of these sectors that need to be improved in the coming time.

Firstly, the legal and policy framework is one of the biggest challenges for business operations in the past three years. However, this risk factor has been somewhat mitigated as many important laws and policies have been passed by the government and are about to take effect in the recent period.

Secondly, after the period affected by the pandemic and the decline in demand both domestically and for exports, cash flow capacity was definitely affected, especially for small and medium-sized enterprises in many sectors.

Thirdly, many businesses do not have a clear capital strategy and business plan, and their cash flow forecasts are not highly reliable in the face of changes in the business environment.

CREDIT INSTITUTIONS AND INDIVIDUALS ARE THE “MAIN PLAYERS” IN THE CORPORATE BOND MARKET

According to the State Bank of Vietnam, by the end of 2023, Vietnam’s credit/GDP ratio was about 133%, up from about 125% at the end of 2022, posing risks to the safety of the financial and monetary system. About 80% of the capital mobilized by banks is short-term capital, so if lending to capital-intensive sectors such as real estate, infrastructure, renewable energy, etc. is increased, the risk of maturity mismatch is very high.

Therefore, it is urgent to open up the corporate bond market for businesses to raise medium and long-term capital.

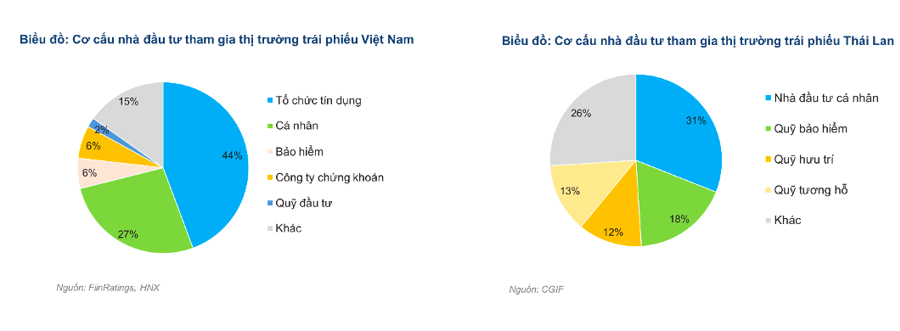

However, according to a survey by FiinRatings, 70% of investors in Vietnam’s corporate bond market are still credit institutions and individuals. Meanwhile, a CGIF representative said that in Thailand, the investor base is much more diversified with the participation of insurance funds, pension funds, or mutual funds; even state investment institutions also participate.

An expert said that there are still very large domestic capital sources that have not been tapped; specifically, insurance companies with total assets under management (AUM) of up to 913 trillion VND at the end of 2023.

According to him, most of their portfolios are still allocated to bank deposits or Government bonds; with very low yields of only 4-6%. Meanwhile, the growth of the insurance industry (also accompanied by future debt obligations) is still at 15-20%/year although new insurance revenue has declined in 2023, leading to certain pressures in the long term for insurance fund managers. Corporate bonds can help diversify portfolios, bring better returns, and also have longer terms, which is suitable for the debt obligations of insurance companies.

On this issue, representatives of some insurance investment funds said that the restriction on investing in bonds that have been restructured under the Law on Insurance Business which took effect from the beginning of 2023 has limited their ability to allocate assets, while they are very interested in investing in the corporate bond channel.

Currently, insurance companies are not allowed to buy corporate bonds issued for the purpose of restructuring the debts of the issuing companies themselves. According to experts, in practice, this may not be reasonable for the company’s operations, because the stages of a project can have different risk profiles; along with that, it is also suitable for different types of businesses.

“The current restrictions in the law on insurance business and corporate bonds make it difficult for insurance companies to divide bonds into different specific purposes.

If this bottleneck is resolved, it will be a very important factor to open up domestic capital sources, especially long-term capital sources for sustainable business development”.

Mr. Nguyen Nhật Hoàng gave an example of an infrastructure project, transportation: The construction phase usually has higher risks (because there is no revenue from commercial operation), and lasts about 2-5 years. Here, commercial banks will likely be the main lenders for this phase. When the project is completed and put into operation, the project can be exploited for the next 10-20 years and bring more stable cash flow, and this may be more suitable for insurance companies.

Meanwhile, banks may be limited in providing medium- to long-term loans (more than 5 years) due to the need to comply with many ratios prescribed by the State Bank of Vietnam, such as the short-term capital ratio for medium and long-term loans). Therefore, Mr. Hoang said that refinancing or restructuring capital sources does not necessarily always have negative implications; and in fact, in other countries, it is quite common for different stages of a long-term project to be financed by different subjects.

According to Mr. Hoang, the current restrictions in the law on insurance business and corporate bonds make it difficult for insurance companies to divide bonds into different specific purposes. If this bottleneck is resolved, it will be a very important factor to open up domestic capital sources, especially long-term capital sources for sustainable business development.