Update

Saigonbank’s Annual General Meeting of Shareholders (AGM) 2024 was held on the morning of April 25, 2024.

|

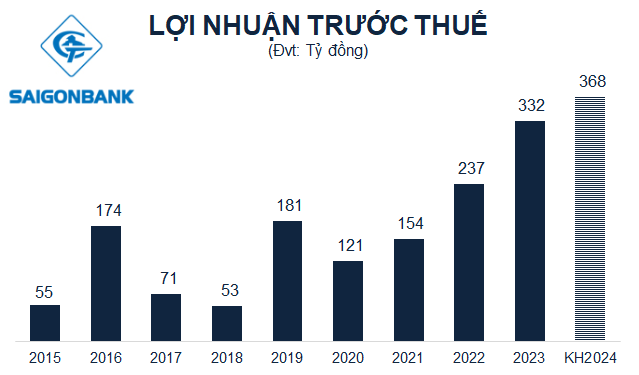

2024 Pre-tax Profit Target Set at VND 368 Billion, an 11% Increase

In 2024, Saigonbank aims to finalize the approval of the Restructuring Plan Combined with Bad Debt Treatment for the period 2021-2025. At the same time, the bank will implement solutions to recover outstanding debts to increase revenue, control non-performing loans (NPLs) in the balance sheet, NPLs sold to VAMC, and debts subject to debt classification measures as prescribed.

Saigonbank targets to achieve total assets of VND 32,300 billion by the end of 2024, an increase of 3% compared to the beginning of the year. Mobilized capital and loans outstanding are expected to reach VND 27,300 billion and VND 23,000 billion, respectively, representing increases of 3% and 12.87% compared to the beginning of the year. NPLs controlled as prescribed are below 3%. The pre-tax profit target for 2024 is VND 368 billion, up nearly 11% compared to the result in 2023.

Source: VietstockFinance

|

Approximately VND 227 Billion in Remaining Profit

In 2023, Saigonbank earned more than VND 332 billion in pre-tax profit and nearly VND 267 billion in after-tax profit. After allocating to funds and provisions, Saigonbank has approximately VND 227 billion remaining. The Board of Directors (BOD) submits to the AGM the decision to allocate funds for employee bonuses and benefits, management funds, and to allocate sources to increase charter capital in the form of issuing shares to pay dividends to shareholders.

Mr. Tran Thanh Giang – General Director of SGB, delivers the opening remarks at the AGM.

|

At the AGM, General Director Tran Thanh Giang announced that Saigonbank has notified April 24, 2024 as the record date for determining the list of shareholders entitled to receive stock dividends.

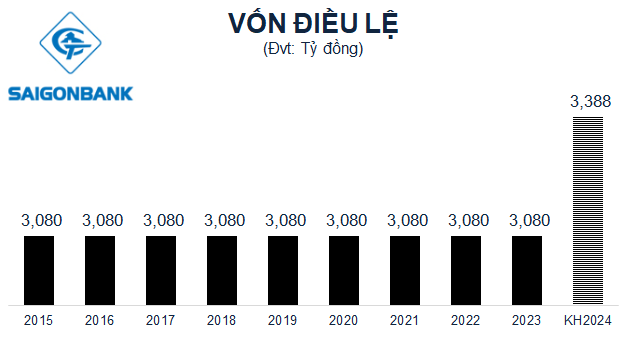

Saigonbank plans to issue 30.8 million shares to pay dividends to shareholders at a ratio of 10% (owning 100 shares will receive 10 new shares). The total issuance value is VND 308 billion.

The capital source will come from the accumulated retained earnings after tax (from 2016 onwards, 2017-2021) and the after-tax profit in 2022 after allocating to funds.

At the end of 2023, the State Bank of Vietnam (SBV) issued a document approving Saigonbank’s request to increase charter capital in 2023. Accordingly, the SBV approved SaigonBank to increase its charter capital by a maximum of VND 308 billion, in the form of issuing shares to pay dividends to existing shareholders approved by the AGM. If the issuance is successful, SGB’s charter capital will increase from VND 3,080 billion to VND 3,388 billion.

Source: VietstockFinance

|

The BOD also submits to the AGM the salary and bonus funds for management implemented in 2023, totaling VND 10.38 billion. The bonus for 2024 is expected to decrease to VND 7.8 billion.

Discussion:

When it comes to the banking sector, bad debts are inevitable.

How much of the old bad debts have been recovered? Are there any new bad debts?

When it comes to the banking sector, bad debts are inevitable. There are many stories related to this issue, such as businesses that, for some reason, turn their debts into bad debts, and banks having to work with their customers.

In addition, supply chain disruptions and difficulties in exporting also make it difficult to repay debts.

SGB accurately assesses the nature of the debts of each group, without hiding anything, in order to find the right treatment approach.

Where do the provisions go?

They are fully deposited at the bank, recorded in the bank’s books, and subject to strict audit. The provisioned funds are kept there for future bad debt treatment.

Shareholders only like cash, what about stock dividends?

The bank has sufficient funds to pay cash dividends to shareholders, but the SBV currently encourages dividend payments in the form of shares to increase the bank’s capital. In addition, if shares are issued, they can be easily converted into cash. The current market price is VND 13,300 per share. The bank’s efforts are also reflected in the market price.

How does SGB manage its hotel subsidiaries?

SGB only owns 11% of Halong Hotel JSC, so it does not participate in management, and can only appoint 1 member to the Board of Directors and 1 member to the Supervisory Board.

Although the tourism industry has not grown much in recent years, this hotel has accumulated funds for expansion investments.

The Board of Directors in 2023 consisted of 5 members. Will there be any difficulties in the future?

Most banks are currently facing difficulties and challenges. SGB is confident that it can lead the bank through these difficulties.

Due to recent events, one Board member has lost their qualification. Currently, SGB’s Board of Directors still consists of 5 members, and has received support from the Municipal Party Committee Office and the State Bank of Vietnam.

The next step will be to organize an extraordinary AGM to elect a new Board of Directors for the next term, as the current term ends in October 2024. SGB is in the process of selecting candidates and submitting them to the SBV for review and approval.

An additional 8% dividend is expected to be declared at the extraordinary AGM

Shouldn’t the AGM decide on dividend payments?

Chairman Vu Quang Lam: The dividend payment was decided by the 2023 AGM, but it was only in April 2024 that the competent authority approved the 10% dividend payment as prescribed. Once approved, SGB will be able to proceed with the distribution.

SGB will submit to the extraordinary AGM to decide on the dividend for 2024. Initially, an additional 8% is expected to be declared, if there are no changes. The authority still belongs to the AGM.

First quarter 2024 business results?

Total assets were VND 31,863 billion, mobilized capital was VND 27,069 billion, and loans were VND 19,739 billion. Pre-tax profit was nearly VND 68 billion, down 35% year-on-year.

In the first quarter of the year, large businesses left the market, and banks were not immune to this general situation, but SGB continued to provide support, developing alongside businesses. As a result, bad debts were bound to increase, but the increase was still within control, ensuring the bank’s safety.

Bad debt treatment is extremely difficult

Plans to