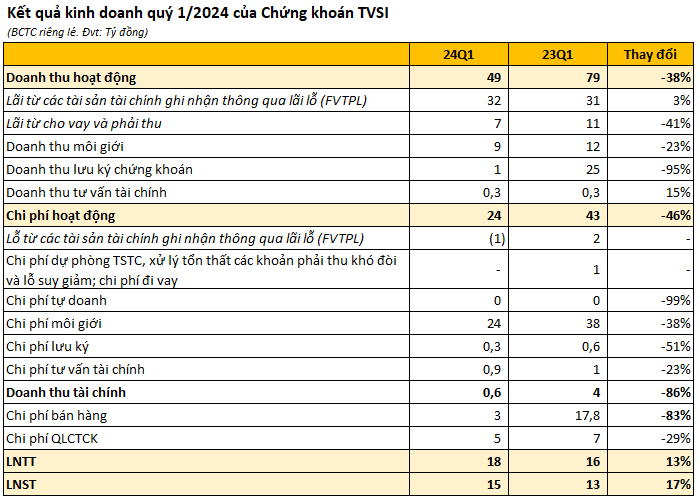

Tan Viet Securities Corporation (TVSI) has just published its financial statement for the first quarter of 2024, recording a 38% decrease in operating revenue compared to the same period last year, down to 49 billion VND, mainly due to a significant drop in FVTPL profit, with a slight 3% increase at 32 billion VND.

At the end of March 31, 2024, TVSI was holding over 1,785 billion VND in FVTPL assets, of which 1,584 billion VND were unlisted bonds, a slight decrease of 55 billion VND compared to the end of 2023; the remaining 172 billion VND were stocks.

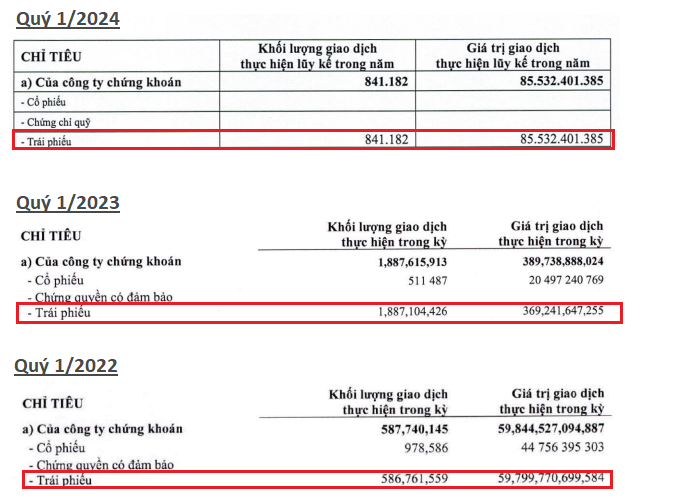

It should be noted that in terms of trading value in the first 3 months of 2024, TVSI did not execute any stock transactions and only traded less than 86 billion VND worth of bonds. This is significantly lower than the 400 billion VND in bond trading volume recorded in Q1/2023 and falls short of the 60,000 billion VND in bond trading volume in Q1/2022. Notably, the amount of bonds held by TVSI during this period remained relatively stable, fluctuating between 1,500 and 1,600 billion VND.

TVSI’s bond trading volumes in Q1 from 2022 to 2024

Interest and receivables for Q1/2024 decreased by 41% year-over-year to 7 billion VND. Outstanding loans at the end of Q1 were 275 billion VND, of which 259 billion VND were margin loans, an increase of 55 billion VND compared to the beginning of the year.

Operating expenses fell sharply by 46% to 24 billion VND, due to lower proprietary trading losses and a 38% reduction in proprietary trading expenses year-over-year, which amounted to 24 billion VND.

After deducting expenses, TVSI recorded a post-tax profit of 15 billion VND, an increase of 17% compared to the same period in 2023. Previously, in Q4/2023, the company reported a loss of over 60 billion VND, making it the brokerage firm with the largest loss in the industry in the last quarter as well as in 2023 (with a loss of 397 billion VND in 2023).

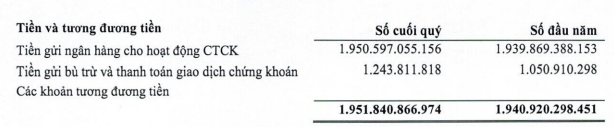

As of March 31, 2024, total assets reached 4,061 billion VND, of which TVSI held nearly 1,951 billion VND in bank deposits for brokerage activities, a slight increase compared to the end of 2023. It is likely that a large portion of these deposits are currently frozen at Saigon Commercial Bank (SCB).

Previously, according to the audited financial statements for 2023, as of December 31, 2023, the auditors emphasized that TVSI still had approximately 1,625 billion VND in deposits at SCB that were frozen, including 889 billion VND in investor deposits for securities trading and 736 billion VND in deposits for other payment obligations to clients that could not be traded, plus a balance of 29 billion VND in SCB deposit certificates.

In addition, according to the auditors’ report in the audited financial statements, the total face value of repurchase agreements signed by TVSI up to the date of the report’s issuance (March 20, 2024) was still approximately 16,491 billion VND, of which the amount due but unpaid was approximately 16,477 billion VND. However, TVSI was unable to make the payments and sent a notice to investors that it would not execute the transactions and was negotiating to cancel the contracts or extend the bond repurchase period, but the negotiations have not yet yielded any concrete results. TVSI did not record these bonds in its financial statements.

Tan Viet Securities is known for its involvement in the Van Thinh Phat Group ecosystem, which was once chaired by Ms. Truong My Lan. The company was one of the bond issuance consultants for An Dong Investment Group Joint Stock Company, an enterprise linked to the Van Thinh Phat Group.

TVSI was later heavily penalized by the State Securities Commission for violations related to its corporate bond issuance consulting activities. The company was also placed under special control while the Vietnam Stock Exchange (VNX) decided to suspend TVSI’s securities purchase activities on the ni