Crude oil reduces by more than $1 per barrel

Oil prices decreased by $1 per barrel on Wednesday due to the increase in crude oil inventory and the potential security threat to the United States, which could reduce oil demand in the world’s largest economy.

Brent crude oil ended the session down $1.17, or 1.4%, at $81.60 per barrel. US West Texas Intermediate (WTI) crude decreased $1.23, or 1.6%, to $76.64 per barrel.

The Energy Information Administration stated that US crude oil inventories rose by 12 million barrels to 439.5 million barrels last week, surpassing analysts’ expectations, as refinery activity fell to its lowest level since December 2022.

Meanwhile, the Chairman of the US Congressional Intelligence Committee warned about a “serious national security threat” without providing further details, making some oil investors worried.

Gold remains below $2,000, palladium surges

Gold fluctuated below $2,000 per ounce on Wednesday after US inflation data came in hotter than expected, causing investors to reduce bets on the Federal Reserve’s rate cut, while palladium prices surged over 8%.

Spot gold ended the session stable at $1,991.92 per ounce – the lowest price since December 13. US gold futures for April decreased 0.1% to $2,004.3.

Spot palladium increased 8.4% to $935.91, and silver increased 1.9% to $888.54.

Data on Tuesday showed that US consumer prices in January rose more than expected, up 3.1% from the same period last year, higher than the 2.9% growth forecasted by economists in a Reuters poll. This will prevent the Federal Reserve from cutting interest rates soon. Higher interest rates increase the opportunity cost of holding gold blocks.

Copper declines

Copper prices decreased on Wednesday as speculators intensified selling after US inflation data raised concerns that the rate cut process will be delayed.

The three-month copper contract on the London Metal Exchange (LME) dropped 0.7% to $8,206 per tonne. However, many analysts and investors believe that copper will eventually recover as the market tightens.

Coffee prices decrease

Arabica coffee prices decreased due to rain in Brazil boosting the prospects of the country’s crop and the increase in inventory on the exchange. ICE-certified Arabica coffee inventory as of February 13 stood at 297,445 bags, up 19% from 249,829 bags at the end of January.

May Arabica coffee decreased 5.25 cents, or 2.8%, to $1.828 per pound. May Robusta coffee decreased 2.3% to $3,090 per tonne.

Corn and soybeans slump to a 3-year low, wheat also decreases

Soybean and corn prices fell to the lowest level in three years as funds sold heavily and the US dollar reached a three-month high, raising concerns about competition for US agricultural exports.

Soybean contract in Chicago decreased to $11.71-1/2, the lowest level since December 2020 and the lowest level in three years reached last week. Corn prices decreased by 8.5 cents to $4.22-1/4 per bushel, the lowest level for the most traded contract since December 2020. Wheat prices also decreased, with the most traded contract down 16-3/4 cents to $5.80-3/4 per bushel.

Sugar increases

March raw sugar prices increased by 0.07 cent, or 0.3%, to 23.37 cents per pound.

Analysts said that rainfall forecasted in Central-South Brazil this week could reduce concerns about drought conditions, although there are still doubts about whether there will be enough rain to make a significant difference.

White sugar closed at $658.70 per tonne.

Analysts expect raw sugar prices to increase nearly 20% in 2024 compared to 2023 as the global market shifts to a deficit state in the upcoming season.

Rubber continues to increase

Rubber prices increased for the third consecutive session in Japan due to the auto industry’s production expansion plan and the weak yen.

The July rubber contract on the Osaka Exchange (OSE) closed up 4.8 yen, or 1.69%, at 288 yen ($1.91)/kg. The March rubber contract on the SICOM platform of the Singapore Exchange was last traded at 152.30 US cents/kg, down 0.33%.

China’s BYD will establish a new electric vehicle production plant in Mexico, with the goal of establishing an export center to the US.

The two-wheeler segment of India witnessed good growth in January as the rural market continues to recover, while the commercial vehicle segment could also perform well in the next two months, the Indian Automotive Industry Agency said on Wednesday.

Palm oil increases

Palm oil prices in Malaysia increased on Wednesday as January inventories at the world’s leading producer – Malaysia – decreased more than expected.

The April palm oil contract on the Bursa Malaysia Derivatives Exchange increased 47 ringgit, or 1.2%, to close at 3,948 ringgit ($825.42).

Malaysia’s palm oil inventories decreased more than expected to the lowest level in 6 months at the end of January as production fell to its lowest level in 9 months amid stable exports.

Indian import of palm oil, the world’s largest importer of vegetable oils, decreased over 12% in January from the previous month to the lowest level in 3 months due to negative processing margins that prompted refineries to switch to using soybean oil.

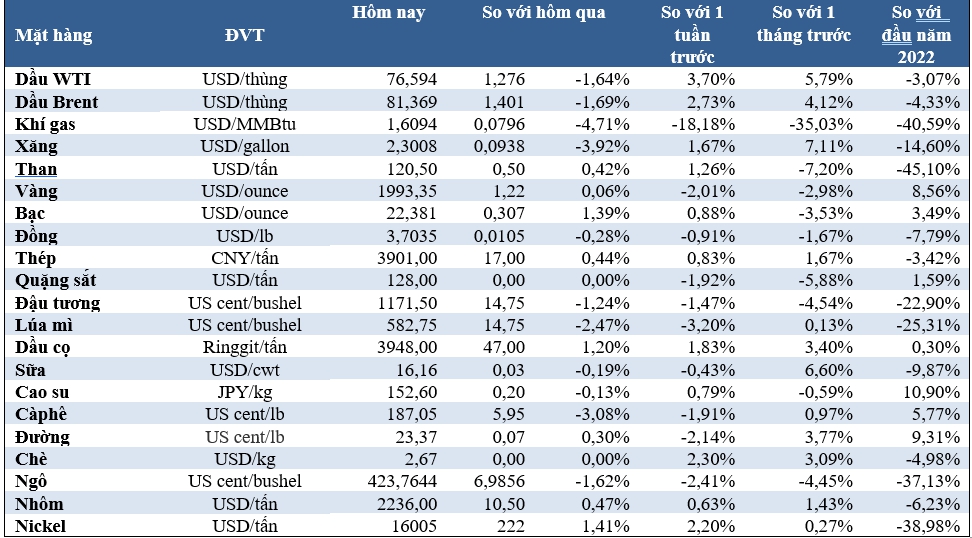

Some key commodity prices as of the morning of February 15: