|

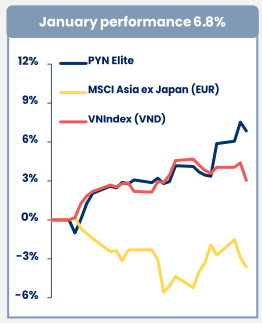

PYN Elite’s Performance vs. VN-Index

Source: PYN Elite Fund

|

VN-Index ended the first trading month of 2024 on a positive note, increasing by 3% compared to the last session of 2023, reaching 1,164.31 points (end of session on 31/01/2024). Among them, banking stocks played a leading role in the market with a higher increase than VN-Index.

|

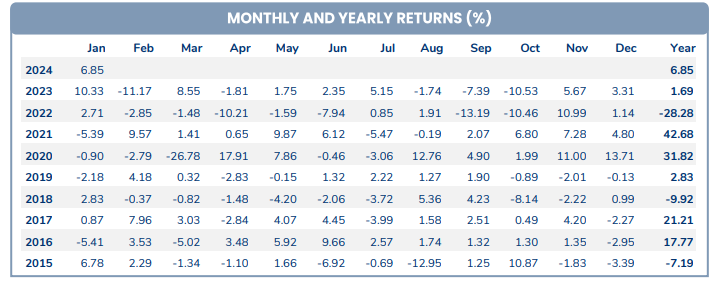

PYN Elite’s Investment Performance in the period 2014-2023

Source: PYN Elite Fund

|

With more than half of the largest investments flowing into the “bank” sector, PYN Elite Fund recorded a 6.85% investment performance increase in January 2024.

The Finnish Fund stated that banking stocks in the fund’s portfolio have rebounded strongly thanks to favorable business results. Specifically, the total income of the 6 banks in the fund’s portfolio in Q4/2023 increased by 31% compared to the same period in 2022. Overall in 2023, the income of the 6 banks in the fund’s portfolio increased by 18% compared to the previous year.

“In Q4/2022, the incident related to the non-listed bank SCB caused temporary tension in the financial market. However, this incident was well handled by the Government and the listed banks not involved, unaffected are expected to grow strongly in 2024.

In addition, the majority of bad debts from SCB’s “internal lending” have been resolved since 2022. The bad debts of the 15 largest normal operating banks have been well maintained and reached a peak of only 2.34% in Q3/2023, then decreased to 1.91% in Q4″, PYN Elite stated.

In terms of macroeconomic situation, trade activities showed growth momentum in January with exports increasing by 6.7% compared to the previous month and by 42% compared to the same period in 2023. Meanwhile, imports increased by 0.1% compared to the previous month and by 33% compared to the same period in 2023. Manufacturing PMI returned to growth at 50.3 in January, supported by an increase in the number of orders and new production.

In addition, realized FDI increased by 9.6% compared to the same period last year, while registered FDI increased by 40.2% compared to the same period.

Inflation decreased and deposit interest rates continued to decline further, nearing the lowest level in history.