Masan Consumer Corporation (Masan Consumer, stock code: MCH) has just submitted to the 2024 annual shareholders’ meeting the decision to list all 717,504,156 outstanding shares of the company on the Ho Chi Minh City Stock Exchange (HOSE).

As of April 17, 2024, MCH was trading on the Upcom exchange with a closing price of VND 138,900, equivalent to a market capitalization of nearly VND 100,000 billion (USD 4 billion). 93.7% of MCH’s share capital is currently owned by parent company Masan Consumer Holdings, with an average 10-session order matching trading volume of approximately 58,500 units.

According to new information announced from the document of the MCH Shareholders’ Meeting, the enterprise also raised the cash dividend to 100% (1 share receiving VND 10,000), previously having provisionally paid 45% and will pay the remaining 55% in 2024.

A recent HSBC analysis report assesses that the transfer of the floor to HOSE could help MCH shares have higher liquidity.

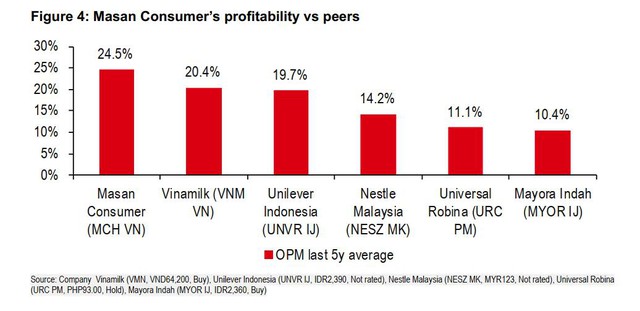

HSBC evaluates that Masan Consumer has a ‘track record’ of high profit margins, stable revenue growth and far exceeding that of peers in the FMCG and packaged food sectors in the region.

Masan Consumer has recorded extraordinary growth since 2018. In 2023, the company set a new record profit level when it recorded a post-tax profit of VND 7,195 billion, up 30% compared to 2022. EPS in 2023 reached VND 9,888 per share, up sharply compared to EPS in 2022 at VND 7,612 per share.

In addition, for Masan’s retail segment, HSBC believes that WinCommerce is at a stage of high capital demand to open new stores and near breakeven. Therefore, the listing of Masan Consumer is a reasonable and more favorable option for the Group. At the same time, this move is also one of the steps to prepare for the strategy of optimizing the value of Masan’s consolidated retail consumer platform, The CrownX (the consolidated platform of MCH and WCM).

As WinCommerce’s EBITDA increases, lower cash needs, and the reduction of benefits in the non-core consumer business, Masan Group will significantly reduce financial pressure.

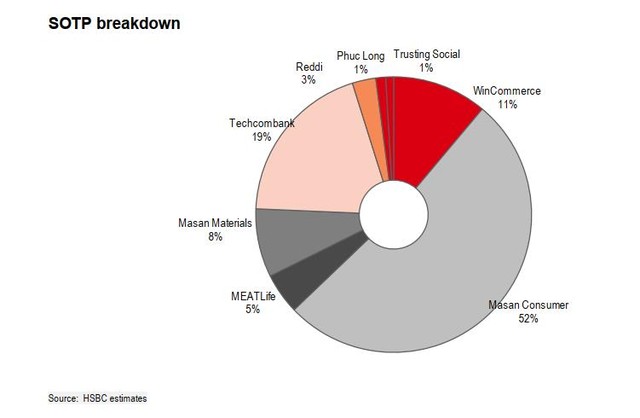

According to data on April 17, Masan Consumer’s market capitalization of USD 4 billion is higher than that of Masan Group (stock code: MSN). Meanwhile, according to the SOPT (sum of the parts) valuation method, HSBC values Masan Consumer at 52% of Masan Group’s value.

Some analytical reports of domestic units also positively assess MSN’s prospects. BSC Securities expects the consumer segment in 2024 to continue to be the main growth segment with the implementation of premiumization trend combined with “Go Global” strategy, inventory and operating cost optimization, simultaneously exploiting the effectiveness of the WIN membership program to create value for the ecosystem.

BSC assesses that the risks related to the settlement of maturing debts and the pressure of maturing debt payments are no longer significant for MSN in 2024 thanks to the operations of the core consumer industry moving towards effective points, MSN’s strategy to reduce financial leverage in 2024 and the expectation of the FED’s monetary easing policy will be implemented in the second half of 2024 will come loan in USD. At WinCommerce, the new store model is gradually proving its effectiveness and continues to expand the number, while improving profit margins by exploiting private label lines, optimizing costs and benefiting from reduced depreciation costs.

According to the financial report for the fourth quarter of 2023 of Masan Group (code MSN: HOSE), this enterprise currently owns about VND 17,000 billion in cash and bank deposits. Masan’s Free Cash Flow (FCF) improved to VND 7,454 billion in 2023, a significant increase compared to VND 887 billion in 2022.

Cash and cash equivalents are expected to increase by approximately VND 7,000 billion after the equity investment led by Bain Capital, and the amount of cash dividends received from MCH and TCB (Techcombank) brings the total amount that the group can hold to 1 billion USD in the coming time.