Photo: Securities HSC

|

At Ho Chi Minh City Securities Corporation (HSC, HOSE: HCM), Dragon Capital Markets Limited registered to exercise all rights to buy approximately 69 million shares of HCM in the offering to existing shareholders from March 6-18, 2024. The expected value of the exercise is 687 billion VND.

Prior to the transaction, Dragon Capital held over 158 million shares of HCM (including 20.6 million shares received from the dividend payment of the 2nd quarter of 2021, ex-date January 30, 2024), equivalent to 30.068% of the capital and is the largest shareholder. If the transaction is completed, the fund will increase its ownership to nearly 227 million HCM shares, with no change in ownership percentage.

In terms of internal connection, Dragon Capital is related to Vice Chairman of the Board of Directors Le Anh Minh and Member of the Board of Directors Le Hoang Anh, both of whom are representatives contributing capital to this fund at HCM. In terms of personal ownership, Mr. Minh currently holds 176,971 HCM shares (0.034% ownership), while Mr. Hoang Anh does not hold any shares.

On the contrary, on February 28, at the Ho Chi Minh City Stock Exchange (HOSE), the second largest shareholder of HCM, Ho Chi Minh City Financial Investment Company (HFIC), held a public auction of approximately 106 million purchase rights, equivalent to nearly 53 million HCM shares, in the offering to existing shareholders, with a starting price of 7,523 VND/share.

As a result, with 3 domestic investors participating in the auction, HFIC was only able to sell 120,400 purchase rights, with a total value of over 900 million VND.

Prior to that, HCM adjusted the time for transferring the stock purchase rights to existing shareholders from January 16-February 22 to January 16-March 18; the time for registering to purchase and submitting money to buy shares was adjusted from January 16-February 26 to January 16-March 18, 2024.

In early January 2024, HCM completed the offering of nearly 229 million shares to existing shareholders at a 2:1 ratio (2 existing shares can be purchased for 1 new share). The offering price was 10,000 VND/share, equivalent to a total estimated capital raise of over 2,286 billion VND. As planned, HCM plans to use 78.13% of the amount raised (nearly 1.8 trillion VND) for margin trading activities, and the remaining 21.87% for proprietary trading activities.

As of January 10, the State Securities Commission of Vietnam (SSC) confirmed the result of issuing over 68.5 million shares to pay dividends for the 2nd quarter of 2021 to HCM‘s shareholders. As a result, the company’s charter capital increased to over 5,266 billion VND.

If the offering to existing shareholders is successful, HCM‘s charter capital will increase to over 7.5 trillion VND, jumping 3 levels from 8th to 5th in the ranking of securities companies with the largest charter capital on the exchange, surpassing VIX Securities (with a charter capital of nearly 6.7 trillion VND).

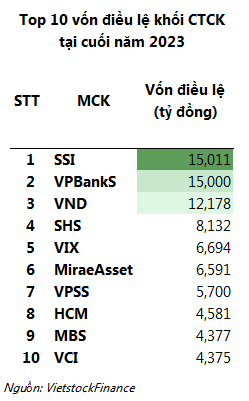

At the end of 2023, the “champion” of the highest charter capital in the securities group belonged to SSI Securities with 15,011 billion VND, followed by VPBank Securities (VPBankS) at 15 trillion VND, and VNDIRECT Securities at over 12 trillion VND.

Attracting major shareholders

Recently, HCM has witnessed fluctuations in major shareholders. Specifically, KIM Vietnam Asset Management Co., Ltd (KIM Vietnam) purchased 1 million HCM shares on January 31, 2024, increasing its ownership percentage from 2.11% to 2.3% (equivalent to over 12 million shares). Based on the closing price of HCM shares on January 31 (26,500 VND/share), it is estimated that the organization spent 26.5 billion VND to complete the transaction.

In 2018, Korea Investment Management (KIM) acquired Hung Viet Fund Management Company and operated as a domestic legal entity from 2020 through 100% ownership of the subsidiary KIM Vietnam. Currently, the scale of KIM Vietnam’s assets under management is nearly 1 billion USD, with Chairman of the BOD and Legal Representative being Mr. Yun Hang Jin.

Through KIM Vietnam, the group of 9 foreign investors associated with KIM has increased their total ownership in HCM from 25.45 million shares (4.84% ownership) to over 26.45 million shares (5.03% ownership) and become a major shareholder on February 2, 2024.

The increase in ownership by the major shareholder occurred as HCM share price approaches the historical high of 32,000 VND/share reached at the end of November 2021. On the morning session of March 1, 2024, HCM traded at 28,600 VND/share, an increase of 20% since the beginning of the year and a 68% increase from its short-term bottom in October 2023. Compared to the offering price to existing shareholders, the share price is currently 186% higher.

| HCM share price from early October 2023 |

In terms of business performance, as of the end of 2023, HCM recorded operating revenue of 2,903 billion VND, a decrease of over 25% compared to the previous year. Pre-tax profit was 842 billion VND, a decrease of 20%, and achieved 93% of the annual profit plan.

| HCM pre-tax profit from 2006-2023 |