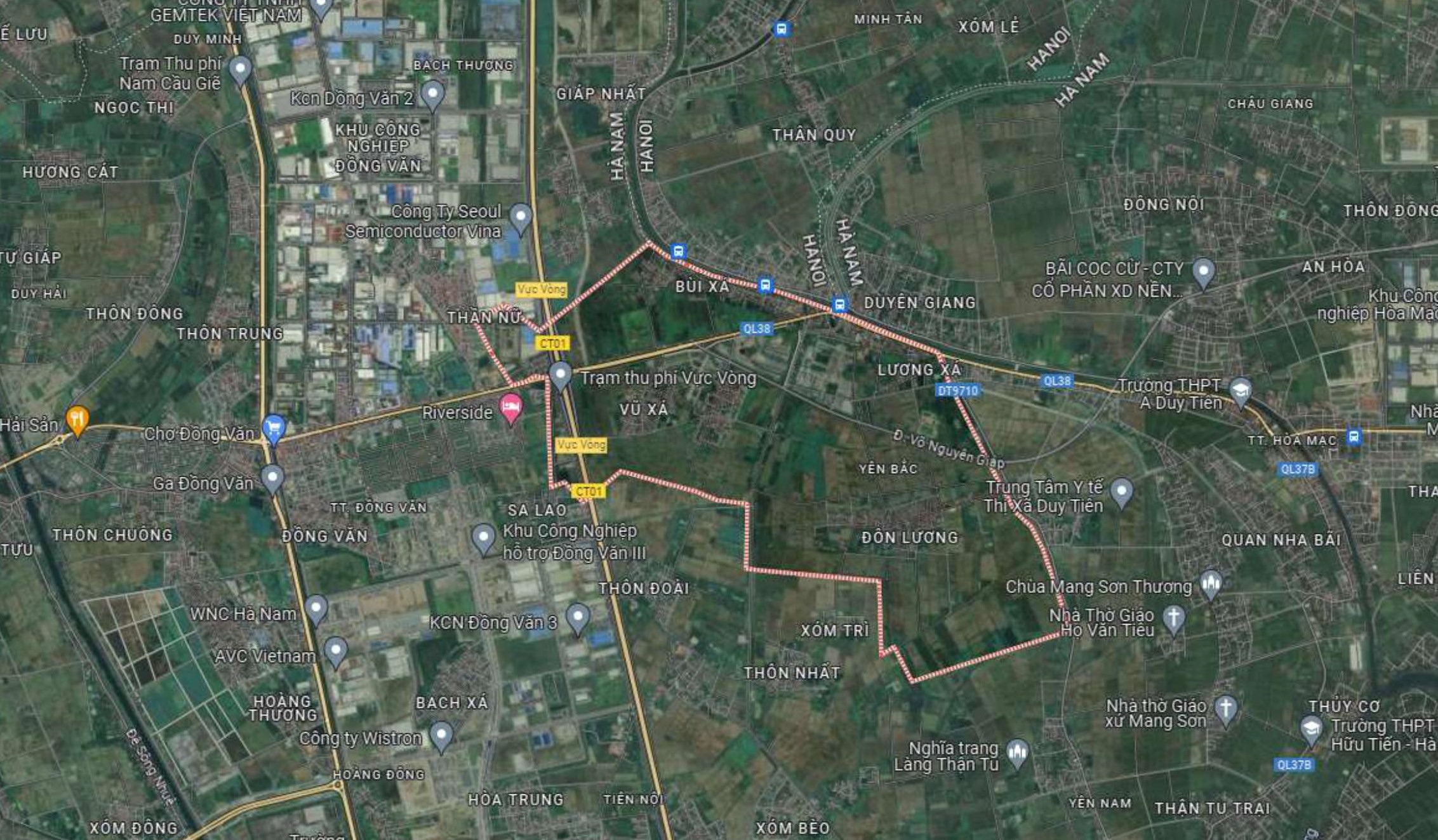

The position of Yen Bac ward, Duy Tien town, Ha Nam province. Source: Google maps

|

In addition to the above consortium, the project also attracts two other investors, BIDGROUP Joint Stock Company and Song Da 7 Urban and Industrial Investment Joint Stock Company registered to participate in construction investment.

The new residential area project is implemented on an area of 10.6 hectares, located in Yen Bac ward, Duy Tien town, Ha Nam province. New residential land is about 3.5 hectares, including resettlement land about 0.11 hectares; high-rise apartment land about 0.5 hectares; green space land about 0.9 hectares; technical infrastructure land after the lot about 0.6 hectares; transportation land about 5.1 hectares. The land area has not been cleared.

The project is scheduled to be implemented from 2023 to 2029, with activities not exceeding 50 years from the date the investor is decided to allocate land, lease land, and change the land use purpose by the competent authority.

The population scale is about 2,500 people. Total investment cost is about 480 billion VND; of which the implementation cost is about 444 billion VND, and compensation and resettlement support cost is nearly 36 billion VND.

The project aims to invest in the construction of a new residential area and a synchronized, modern technical infrastructure system to meet the demand for high-rise and low-rise housing for residents in the area.

Duy Tien town. Source: Ministry of Construction

|

To implement the project, investors need to meet certain capacity requirements. For the consortium, the leading investor of the consortium must contribute a minimum ownership capital ratio 30%, each member contributes at least 15%.

The project requires the investor to arrange at least 88.7 billion VND from the owner’s capital and have experience of implementing 1 project in the field of urban areas; commercial housing; commercial, service projects; civil projects with one or more functions. The project must be completed or at least mostly completed within 5 years.

If the investor has participated in a previous project as a capital contributor, the project must have a minimum total investment of 221.8 billion VND, of which the investor contributed at least 44.3 billion VND. In case the investor or partner participated in the previous project as the main contractor, the project must have a minimum value of 176.4 billion VND.

According to research, at the end of 2022, also in Yen Bac ward, Duy Tien town, the Ha Nam Provincial People’s Committee had decided to terminate the investment policy of two projects, including the project to invest in constructing urban housing in Bach Thuong ward, Yen Bac ward and the project to invest in constructing a new residential area combined with renovating the current residential area in the northern area of Don Luong neighborhood, with the reason that the investors of the two projects were Construction and Trading Joint Stock Company Viet Phat and Song Da 7 Urban and Industrial Investment Joint Stock Company decided to terminate the project activities.

Parting ways since 2018

About Sai Dong Real Estate, this used to be an indirect subsidiary of Dat Xanh Group Joint Stock Company (HOSE: DXG). In 2017, DXG received a transfer from Dat Xanh Northern Services and Real Estate Joint Stock Company and made additional contributions. By the end of this year, the ownership ratio of DXG in Sai Dong Real Estate was increased from 51% to 70.99%.

At the beginning of 2018, DXG decided to transfer all of its shares in Sai Dong Real Estate for 226 billion VND and recognize a profit of 150 billion VND in financial activities revenue.

About Urinco7 Urban and Industrial Investment Joint Stock Company, established since 2007, specializing in real estate investment, housing business and mineral exploitation, civil, industrial, transportation, hydropower and urban areas… The CEO cum legal representative is Mr. Nguyen Manh Thang (1964).

Urinco7 has implemented projects for officials in Hanoi such as projects for Minister-level officials; projects for Deputy Minister-level officials and equivalents; projects for high-ranking office specialists of the National Assembly; projects for officials of the National Burn Institute; projects for officials of Hospital 103…

One of the projects implemented by Urinco7. Source: Urinco7

|

Reviving old projects

Established since 2006 in Hanoi, BIDGROUP introduced itself as a Group specializing in “reviving old projects”. The company’s headquarters are currently located in the new urban area of Dinh Vong Thuong ward, Cau Giay district. The Chairman of the Board of Directors cum legal representative is Mr. Tran Van Manh.

Information from the Hanoi Stock Exchange (HNX) shows that BIDGROUP currently has two outstanding bond issues, coded BIDCH2124001 with a value of 200 billion VND and BIDCH2124002 with a value of 330 billion VND, a 11% annual interest rate, raised since 2021, and expected to expire in May and December this year respectively.

Part of the capital from the 200-billion VND bond issue will be contributed by BIDGROUP into Eden Garden Real Estate Company Limited to implement the construction and renovation project for 4-5-storey collective residential quarters, Le Hong Phong ward, Thai Binh city. This is a bond secured by the entire assets of the issuing enterprise and a third party as specified.

Eden Garden project being implemented by BIDGROUP. Source: BIDGROUP

|

By mid-2023, BIDGROUP’s equity was recorded at 1.6 trillion VND, along with a debt to be paid of 2.5 trillion VND. Despite the difficult real estate market, the company still reported a profit of 2.5 billion VND, nearly twice as much as the same period in 2022, and achieved a post-tax return on equity of 0.16%. At the mid-2023, the payment of principal and interest of BIDGROUP’s bonds is still guaranteed.