In the wood and forestry industry, wood chips and wood pellets share the characteristic of providing heat energy and are used as fuel, not for producing wood products or handicrafts. These two products account for 22% of the total export value of wood and wood products.

WOOD CHIP EXPORTS DECLINE IN VOLUME AND VALUE

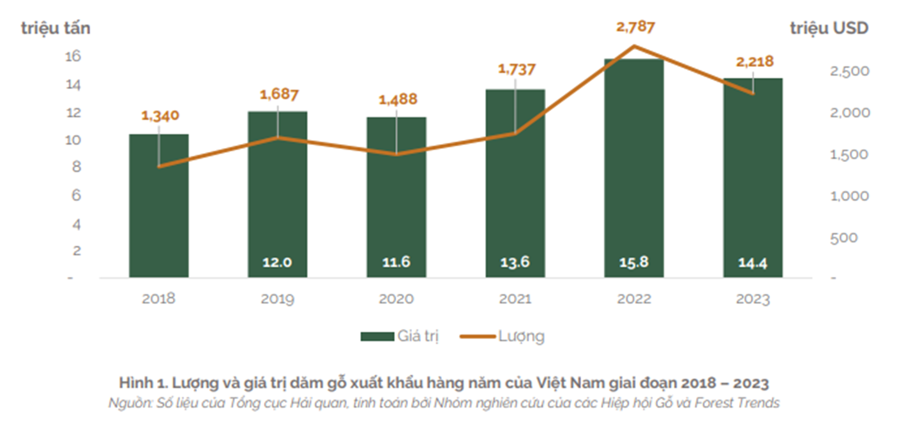

According to the 2023 Wood Industry overview report published by the Vietnam Timber and Forest Products Association, in 2023, Vietnam exported nearly 14.42 million tons of wood chips, amounting to 2.22 billion USD, a decrease of 8.8% in volume and 20.4% in value compared to 2022, accounting for 16.8% of the total wood industry export turnover.

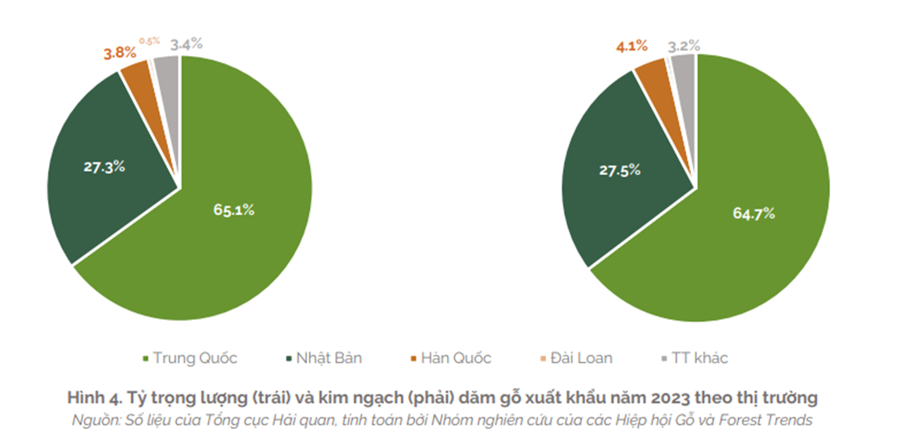

Vietnam exported wood chips to 13 markets in 2023, with China and Japan being the two largest importers, accounting for 92.4% of the total volume and 92.2% of the total export value.

In 2023, China imported over 9.38 million tons of wood chips from Vietnam, equivalent to over 1.435 billion USD, a decrease of 11.8% in volume and 25.2% in value compared to 2022. Meanwhile, Japan imported 3.94 million tons of wood chips from Vietnam, valued at nearly 610 million USD, a decrease of 10.1% in volume and 15.7% in value compared to 2022.

In addition, South Korea and Taiwan also imported a relatively large amount of wood chips from Vietnam. In particular, the import volume of South Korea increased by 12.2% compared to 2022, but due to the sharp decrease in wood chip prices in 2023, the total export turnover decreased slightly by 1.1%. As for the Taiwanese market, both the total volume and total export turnover experienced a significant decline: a decrease of 37.7% in volume and 41.5% in value compared to 2022.

The export prices of wood chips to the three markets – China, Japan, and South Korea – had a similar trend, with a sharp increase throughout 2022 and the beginning of 2023, but started to cool down from the second quarter of 2023 and stabilized towards the end of the year.

Specifically, in December 2023, the export price of wood chips to China was approximately 149 USD/ton, a decrease of 24% compared to the ceiling price of 198 USD/ton in 2022. Similarly, the export price to Japan in December 2023 was 145 USD/ton, a decrease of 24% compared to the peak price of 191 USD/ton in the previous year.

Compared to the two markets above, the average export price to South Korea fluctuated more, increasing to 242 USD/ton in November 2022, but continuously decreasing to 136 USD/ton in September 2023. However, from October 2023, this market showed signs of recovery as wood chip prices rose sharply, reaching over 172 USD/ton in December 2023.

In terms of the wood chip market trend in 2024, Dr. To Xuan Phuc, Executive Director of the Forest Policy Trade Program at Forest Trends, stated that the demand for wood chip imports in China is expected to continue to decline in the near future, leading to a decrease in wood chip export prices to this market.

SOUTH KOREA AND JAPAN REMAIN VIETNAM’S LARGEST WOOD PELLET IMPORT MARKETS

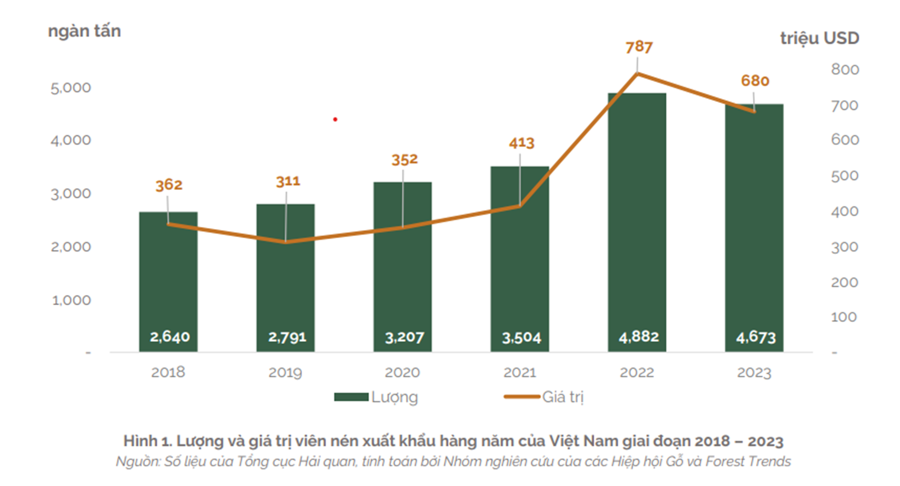

Regarding wood pellet exports in 2023, the Vietnam Timber and Forest Products Association stated that Vietnam exported 4.67 million tons, with an export turnover of 679.59 million USD, a decrease of 4.3% in volume and 13.7% in value compared to 2022, accounting for 5.2% of the total wood industry export turnover.

Compared to the record price increase in 2022, the average export price of wood pellets in 2023 decreased by 9.7%. The price of wood pellets continuously decreased from nearly 190 USD/ton at the end of 2022 to approximately 135-140 USD/ton from April 2023.

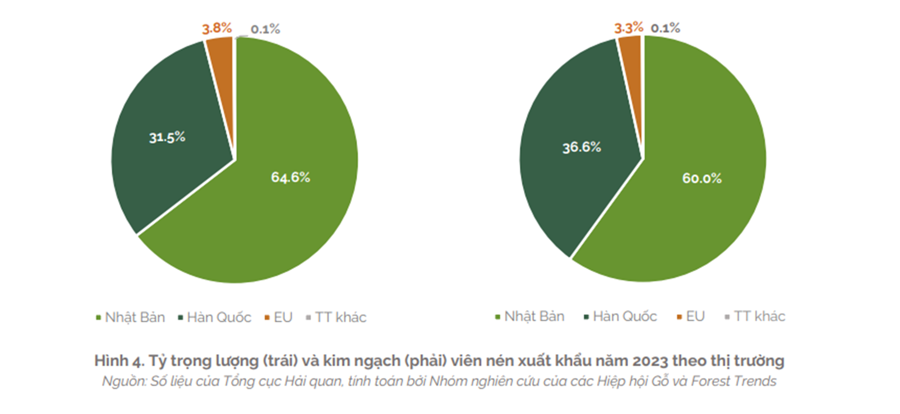

Vietnam’s wood pellet products were exported to 22 countries and territories in 2023. Among them, South Korea and Japan remained the two largest import markets for wood pellets, accounting for 96% of the total volume and 96.6% of the total export turnover of the country.

In 2023, Japan imported more than 2.8 million tons of wood pellets from Vietnam, equivalent to over 438 million USD, an increase of 12.4% in volume and 14.3% in value compared to 2022. Meanwhile, South Korea only imported over 1.7 million tons of wood pellets from Vietnam, valued at nearly 214 million USD, a decrease of 24.5% in volume and 43.3% in value compared to 2022. The sharp decline in wood pellet exports to South Korea was due to South Korean companies having additional alternative supply sources, such as low-cost wood pellets from Russia.

The EU market is evaluated as very potential for wood pellet exports, but its requirements are stricter than those of Japan and South Korea, requiring companies to invest more in equipment and technology in the future.

“One of the biggest challenges of wood pellet exports is the unsustainability of input wood sources in terms of both quantity and standards/quality. To solve these difficulties, the Government needs to have reasonable policy mechanisms, especially policies to balance processing capacity and forest plantation areas,” said Dr. To Xuan Phuc, Executive Director of the Forest Policy Trade Program at Forest Trends.

The competition between wood pellet exports and domestic consumption in terms of wood input sources will occur in the near future. Competition for wood sources between wood pellet and wood chip companies is inevitable, especially with a series of wood pellet and wood chip factory projects being built within the next 3-5 years.

Therefore, according to Dr. To Xuan Phuc, companies and management agencies need to consider investing in building wood source supplies to ensure stable supply for production and exports.