Halving in 2024 is approaching; here is its impact in history.

Expected around April 17, 2024, the fourth halving will reduce the reward for miners from 6.25 BTC to 3.175 BTC at block height 840,000.

There will be a total of 32 halvings, with 29 more halvings predicted until 2140 when the process of creating new BTC ends.

According to data from IntoTheBlock, currently, about 900 Bitcoins are mined daily worldwide, serving as rewards for miners who verify and secure the network.

In history, the value of Bitcoin has surged in the same year as halving events.

Overall, Bitcoin has gone through four price surges coinciding with halving events. Bitcoin reached $1,000 after the 2012 halving and $20,000 after the 2016 event.

The most recent halving occurred in mid-May 2020, preceding a price cycle that peaked in November 2021 at an all-time high of $69,000.

First Halving, 2012

In 2012, Bitcoin was relatively little known. However, a year before the first halving, the price of Bitcoin surged nearly four times.

The first Bitcoin halving event occurred at block 210,000, reducing the block reward from 50 BTC to 25 BTC.

This event created anxiety for cryptocurrency investors who feared it may discourage miners.

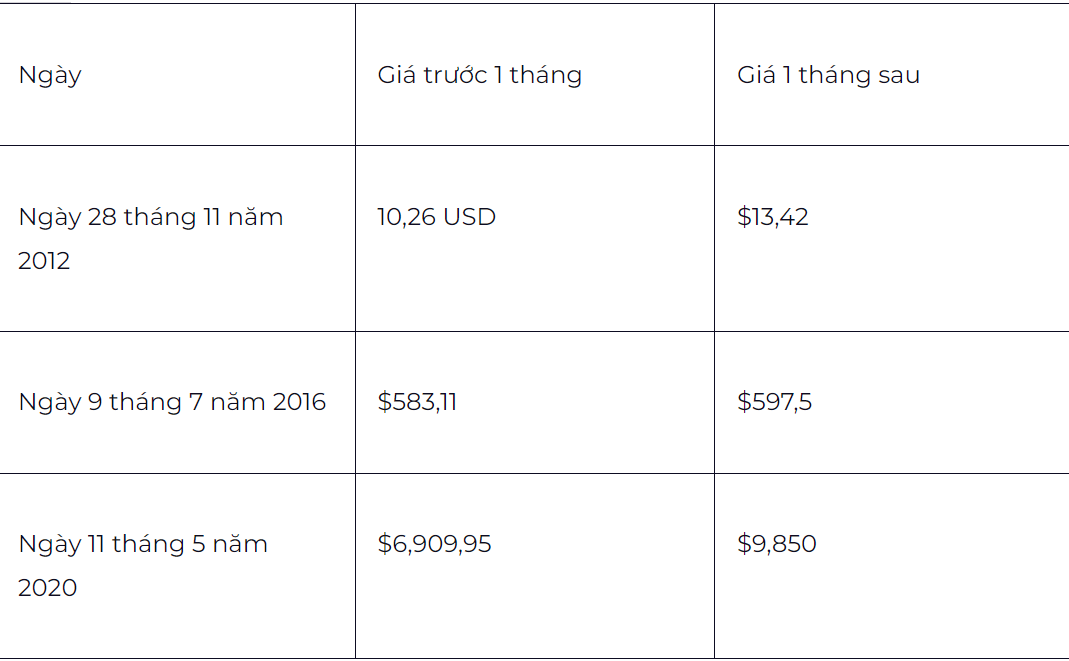

Just one month prior to the 2012 halving, BTC was at $10.26 with little price volatility until the event occurred. One month after the halving, the average price was $13.42.

Second Halving, 2016

The second halving occurred on July 9, 2016, reducing the block reward from 25 BTC to 12.5 BTC, propelling Bitcoin and cryptocurrencies into the limelight, coinciding with the altcoin and ICO frenzy, witnessing a significant rate of scams.

On June 9, 2016, BTC was priced at $583.11 and increased to $597.5 after this event.

The halving event saw Bitcoin’s price rise from around $650 to nearly $19,000 before dropping below $4,000.

Third Halving, 2020

The third halving in 2020 took place amidst the COVID-19 pandemic.

This event, at block 630,000, halved the block reward to 6.25 BTC. Influential investors at this time openly endorsed Bitcoin. As institutions started exploring its adoption, payments via cryptocurrencies grew in popularity.

In the six months leading to the 2020 halving, Bitcoin underwent a 300% price surge.

Prior to the 2020 halving, Bitcoin was trading around $9,000 and reached a record high of $67,549 after the halving, stabilizing at $20,000 for a period of time.

Fourth Halving, 2024

Analyzed historical data from IntoTheBlock shows the rising price trend after halving events, while the current cycle indicates an early price increase, investors may have anticipated the “halving effect.”

A recent report from JPMorgan suggests the possibility of BTC price dropping to $42,000 due to reduced miner rewards and higher production costs from the April halving event.