According to the consolidated financial statements for the fourth quarter of 2024, revenue from car sales remained the main driver for CTF, bringing in over 2 trillion VND out of the total 2.2 trillion VND, a slight decrease compared to the same period in 2022. However, the cost of goods sold increased, resulting in a 30% decrease in CTF’s gross profit, leaving only around 143 billion VND.

During the period, CTF generated revenue from financial activities of 50 billion VND, a 3.2-fold increase compared to the fourth quarter of 2022. However, interest expenses also doubled to nearly 47 billion VND, while selling expenses reached 112 billion VND, a 17% increase, and business management expenses amounted to nearly 33 billion VND, a 29% decrease.

As a result, the net profit after tax was nearly 7 billion VND, a sharp decrease compared to the over 39 billion VND in the same period.

Source: VietstockFinance

|

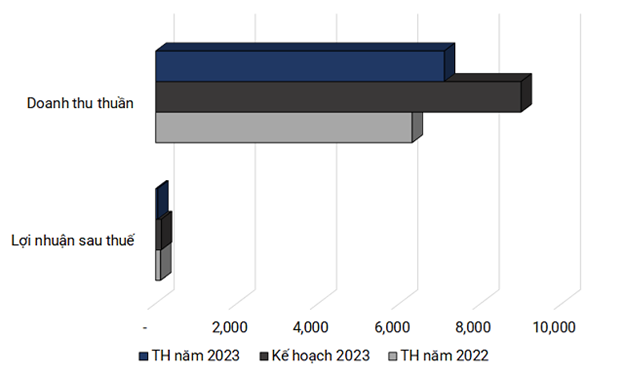

Summing up the full year 2023, although CTF’s revenue increased by 13% compared to the same period, reaching 7.1 trillion VND, its net profit was only 43 billion VND, a 61% decrease, and it failed to achieve the previously set targets.

At the beginning of the year, CTF planned to increase its revenue and sales volume by 42% compared to 2022. However, by now, the company has only achieved 79% and 34% of its targets for revenue and net profit after tax, respectively.

Performance of CTF in 2023 compared to the plan (Unit: billion VND)

Source: VietstockFinance

|

According to CTF’s explanation, in 2023, the global economic recession led to a decline in the automotive business market, which significantly affected purchasing power and consumer demand for cars, impacting all businesses in the industry.

Mr. Nguyen Dang Hoang, CEO of CTF, stated that the annual holiday shopping season in the fourth quarter is usually strong, but this year it was weak due to a significant drop in selling prices, which affected profitability across the industry.

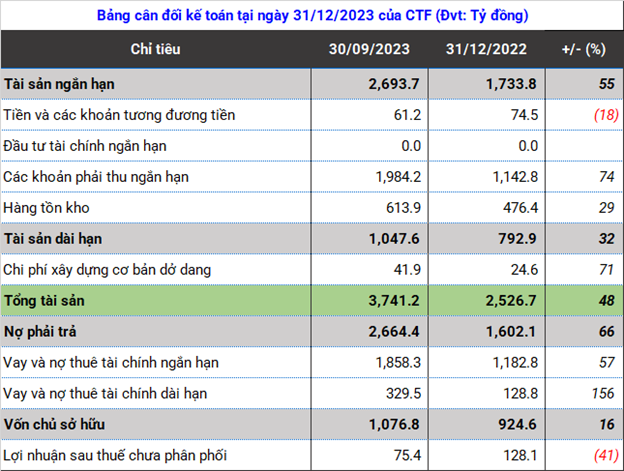

By the end of 2023, the company’s total assets in the automotive business had increased by nearly 50% compared to the beginning of the year. Short-term receivables from customers almost doubled, reaching over 1 trillion VND, with an additional amount of over 500 billion VND. This includes short-term receivables from other customers (accounting for less than 10% of total receivables from customers) which increased by nearly 330 billion VND, and receivables from the major shareholder TTD Group Joint Stock Company increased by about 190 billion VND.

Additionally, advance payments to short-term suppliers increased by 67%, an additional 90 billion VND compared to the beginning of the year, with the highest increase being for Minh Long Ltd and TTD Group.

Short-term receivables from others also increased by 50%, an additional 230 billion VND, mainly from TTD Group, which includes loans to individuals, short-term reserves, and other receivables.

By the end of 2023, CTF’s inventory increased by nearly 30%, reaching 618 billion VND. The largest contribution to this increase came from Phu My Automobile Company, with an additional 90 billion VND, followed by the parent company CTF with 64 billion VND, Nha Trang Automobile Company with nearly 30 billion VND, and Auto Truong Chinh Ltd, which decreased by over 60 billion VND.

In addition, long-term financial investments also saw a significant increase in 2023, from 115 billion VND to 408 billion VND. During the period, CTF invested in the establishment of Dĩ An – Bình Dương Auto Joint Stock Company, owning 20% of its share capital valued at 26 billion VND, and made additional investments in Dasonmotors Joint Stock Company, acquiring 15% of its capital with a value of 160.2 billion VND.

Source: VietstockFinance

|

During the past year, CTF officially operated the largest Ford showroom in Southeast Asia, Tân Thuận Ford Showroom. In 2024, the company plans to continue opening a Ford showroom in Dĩ An, Bình Dương.

“This is an important prerequisite for the development of CTF’s distribution system, creating competitive advantages and growth momentum for the future. The company will continue to plan additional showroom investments each year,” said Mr. Hoang.

However, Mr. Hoang also noted that the first half of the year would still face many difficulties, especially in the first quarter when purchasing power is not yet strong. It is only after the second quarter that stronger movements and an uptick in purchasing power and consumption are expected.