The stock market has just experienced a strong fluctuation with a trading volume of over 40,000 billion, the second highest in history. This lively trading contributed significantly to the stock of DIC Corp (DIG).

The stock traded nearly 79 million units, equivalent to a trading value of nearly 2,400 billion VND, the highest on the stock exchange on March 18. This is also the second highest trading volume in the history of DIG listed, second only to the equitization session through the floor of the Ministry of Construction at the end of November 2017.

The money “rushed in” pushing up the price of DIG sharply despite the market losing over 40 points in the session on March 18. This stock even hit the ceiling at 30,450 dong/share when the VN-Index “retreated” at the end of the session. Notably, most of the transactions took place at the highest price range in nearly 18 months since the end of September 2022.

Investors seem to be unabashedly chasing DIG orders despite the stock having risen sharply recently. Since the short-term bottom confirmed 5 months ago, the DIG stock price has increased nearly by 60%. However, compared to the historical peak reached in mid-January 2022, this stock is still 70% lower. The “loyal” shareholders who bought at the peak 2 years ago have yet to see the day of “return”.

In the past, DIG was a very “hot” name in the period from late 2021 to early 2022. Along with the “tsunami” on the stock exchange, the number of shareholders of DIC Corp also increased more than 4 times in a year, reaching more than 48,000 shareholders (as of March 21, 2022). The coverage of DIG on major stock investment forums was so extensive that even the venue for the regular 2022 shareholders’ meeting of DIC Corp was not enough for shareholders to attend.

However, the “enthusiasm” of shareholders with DIC Corp’s plans gradually faded as the stock wave receded. Only six months later, the extraordinary shareholders’ meeting scheduled to take place in mid-September 2022 of DIC Corp could not be held due to insufficient attending shareholders as regulated. The second general meeting was then successfully held on October 12, 2022. A month later, DIG stock plummeted to nearly face value, equivalent to “evaporating” nearly 90% compared to the peak.

At the end of June 2023, the first regular annual shareholders’ meeting 2023 of DIC Corp once again could not be held. It was not until mid-July last year that this real estate business successfully organized the second regular annual shareholders’ meeting 2023 with the attendance and authorization of shareholders representing 37.58% of voting shares.

Since then, DIG stock has gone through its ups and downs but the recovery trend has become clearer since mid-October last year. The stock has been rising against the backdrop of DIC Corp’s business situation showing signs of a less difficult transformation.

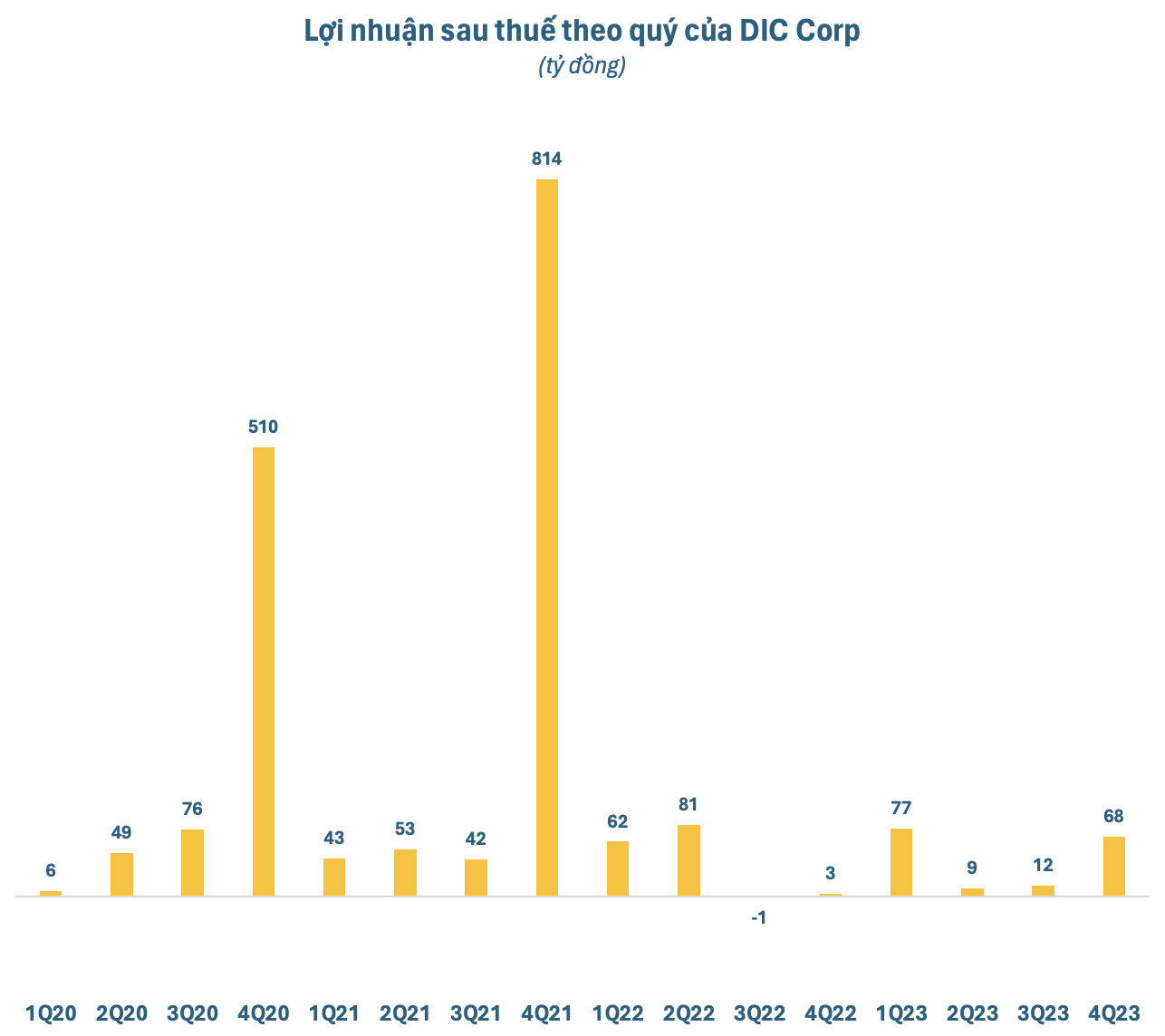

In the fourth quarter of 2023, the company recorded revenue of nearly 434 billion VND, up 11% and after-tax profit reached 67.6 billion VND, 25 times higher than the same period in 2022. The revenue during the period of DIC Corp mainly came from real estate business activities such as transferring apartments at the Gateway Vung Tau project; transferring CSJ apartments; transferring land use rights in the Nam Vinh Yen project; transferring rough construction houses in the Dai Phuoc project, Hiep Phuoc project, and Hau Giang project.

Accumulated throughout 2023, DIC Corp achieved nearly 1,028 billion in net revenue, down 46% compared to 2022. Of which, the largest contribution came from the real estate business sector with over 545 billion VND, accounting for 53% of the revenue structure; there are also construction and supply service sectors. However, thanks to the sudden financial revenue and cost reduction, the after-tax profit in 2023 of DIC Corp still increased 14.5% compared to the previous year 2022.

In terms of financial situation, DIC Corp’s total payable debt at the end of 2023 was at 8,935 billion VND. Of which, the financial borrowed debt of the enterprise decreased by 733 billion VND compared to the beginning of the year, down to 3,112 billion VND. The decrease mainly came from the amount of DIC Corp bonds settled last year, with a bond debt reduced from 1,862 billion to 1,142 billion VND.

On March 20, DIC Corp will finalize the list of shareholders attending the regular annual 2024 shareholders’ meeting, expected to be held in April in Ba Ria – Vung Tau province. At the General Meeting, DIC Corp is expected to present to shareholders a report on the business results of 2023; business plans for 2024; plans for the operation of the Board of Directors in 2024,…